On Monday, February 26th, Amazon.com Inc. (AMZN) replaced Walgreens Boots Alliance, Inc. (WBA) in the Dow Jones Industrial Average. Many investors might look at that headline and think that it’s a good time to buy AMZN.

Maybe that’s the holy grail of investing, or perhaps it’s just noise.

We’ll look at a few prior instances of additions and deletions from the Dow to form our own thoughts on the subject.

Outdated Methodology

There is one main problem with the construction of the Dow. The index is price-weighted. That means that the higher the price of the stock, the more weight it will have in the index. That differs from an index such as the S&P 500 which is weighted by market capitalization. The flaw of the Dow is that a stock’s trading price is mostly insignificant. All else equal, buying a $500 stock vs. a $100 stock shouldn’t make a difference.

The result of this is that the Dow would consider UnitedHealth Group Inc. (UNH) as the most important company in the world… for no other reason than because the price is $527. That’s higher than Apple, Amazon, Microsoft, etc.

To further illustrate the flaw, I’ll leave it at this: As of Monday, AMZN has a lower weight than McDonald’s Corporation (MCD) and thus, less significance in the Dow. Unless you really love fast food more than one-day delivery, you get the point.

Dow Changes Since 2015

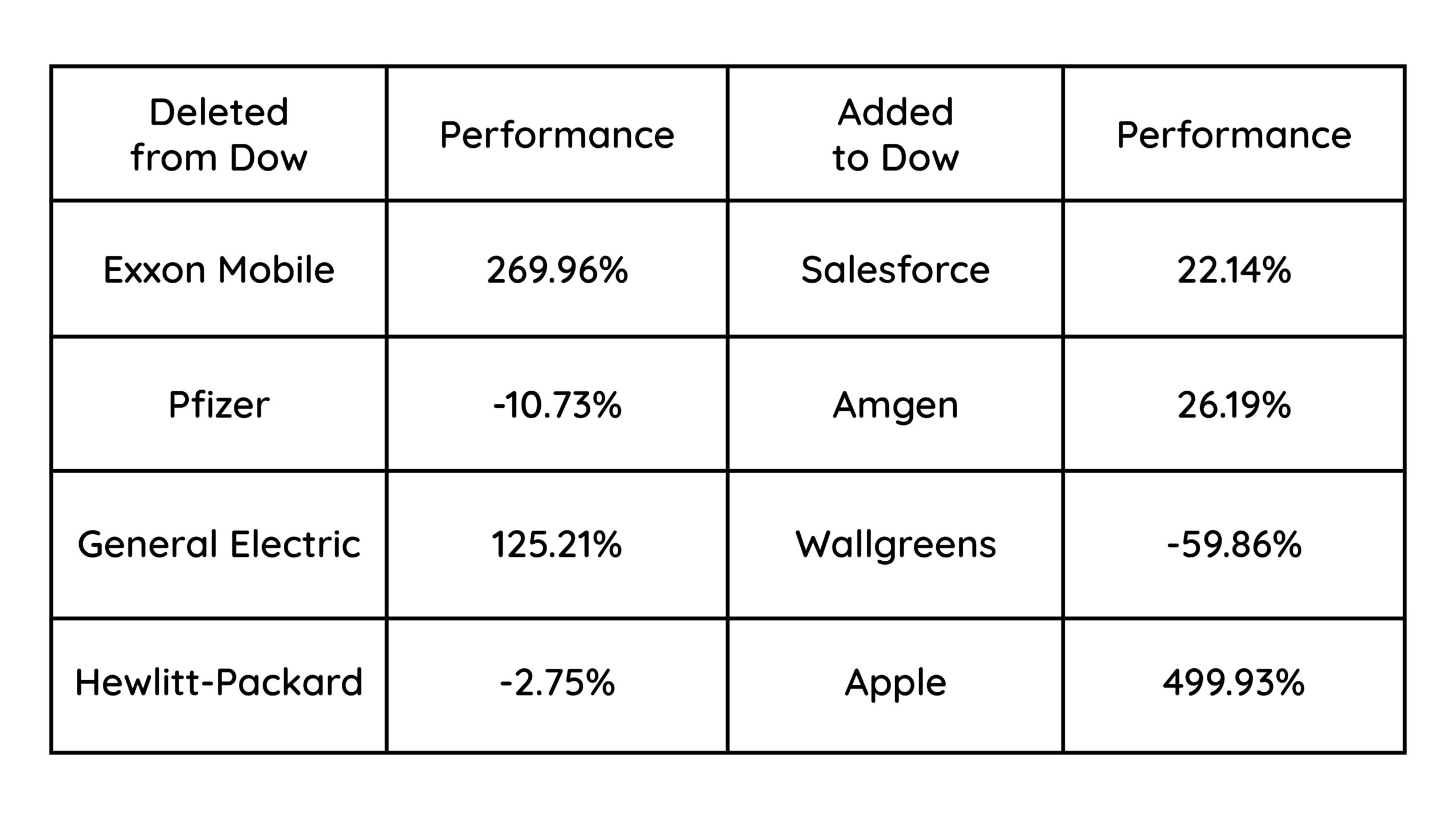

Excluding corporate action, charts of the last four changes to the Dow are below. All Black lines are the stocks that were added, and all Yellow are the stocks removed. If you want to skip to the table of results, click here.

On 8/31/2020 Salesforce Inc (CRM) replaced ExxonMobil Inc (XOM). Since then, XOM has outperformed by over 200%.

That same day Amgen Inc (AMGN) replaced Pfizer Inc (PFE). Pfizer managed to outperform for a few years before lagging.

On 6/26/2018, WBA replaced General Electric Company (GE). WBA has underperformed by over 175% since it took the place of GE.

On March 18, 2015, Apple Inc (AAPL) replaced HP Inc. (HP). This may have been the best trade ever by whatever committee decides these things. AAPL +499.93%, HP –2.75%.

Here is the data in table form:

Check the Narratives

With only a few changes made since 2015, the results are inconclusive, and the sample is small. The point isn’t to create a trading strategy around this. The point is that being included in an index may not have the effect some would think.

Buy and hold isn’t our thing. Data and testing that data is.

We showed today that buying stocks for the sole reason that they’re added into an index may not be the best idea. Or, to take it a step further, having a theory about why a news headline, index addition, FED decision etc. will move a stock in your favor may be a dangerous game to play.

Look at the data and then decide if you want to make decisions based on it.

Potomac Fund Management ("Potomac") is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-613-20240326