By

Potomac

•

Dec 5, 2024

Understanding how distributions work is essential for all mutual fund shareholders. Dividends and capital gains directly affect a fund's net asset value (NAV), which can be alarming to investors if they don't understand total return.

In this blog, we will answer four questions which explain the mutual fund distribution process:

What are the types of distributions that can occur?

What is total return?

Why do Mutual Funds make distributions?

When do these distributions occur?

Types of Income

Mutual funds generate two primary types of income:

Dividends

Capital Gains

Short-term (taxed as income like dividends)

Long-term (taxed on different scale than income)

Dividends

Dividends come from income earned by a fund's underlying holdings. This is similar to bond funds that have a dividend yield, a concept familiar to most investors.

If the holdings within a mutual fund pay dividends or interest, that income must be distributed to the fund's shareholders. This is a regulatory requirement.

Depending on the holdings of the fund and time frame, dividends can be classified as either ordinary or qualified. The distinction is their tax treatment, which is beyond the scope of this blog.

Capital Gains

Capital gains occur when a fund buys and sells securities within its portfolio.

For example, if a fund buys stock A for $100 and later sells it for $120, it has generated a $20 capital gain. This gain is distributed back to the fund's shareholders as regulations require.

These payouts, known as capital gain distributions, are classified as short-term or long-term based on how long the fund held the securities before selling. Capital gain distributions qualify as long-term if the asset was held for more than 1 year.

NAV Adjustment

When capital gains are distributed, the NAV of the mutual fund decreases by the distribution amount. For those unfamiliar with this process, the NAV drop might seem concerning, but it doesn't change the investor's total return.

If a fund's NAV is $10 and a $2 distribution occurs, the NAV decreases to $8 on the day of the distribution. The investor's total return remains unchanged:

NAV post-distribution: $8

Distribution: $2

The fund investor now has $2 to do with as they please. They can choose to reinvest back into the fund, or they can choose to deploy that capital elsewhere if the distribution is paid in cash.

The important point is that the investor DID NOT "lose $2."

Total return:

If the investor has distributions paid out (not reinvested), then $8 + $2 = $10 (the same as the pre-distribution NAV)

If the investor is reinvesting the distribution, they will own more shares at the lower NAV effectively getting them to the same total value for the investment.

Total Return vs. Price Return

Total return includes all distributions and is the true measure of a fund's performance. Unfortunately, some investors mistakenly view NAV alone as their total return, causing unnecessary panic following distributions.

Further adding to the confusion, custodian statements may only show current position gain/loss, which is not total return if distributions aren't accounted for.

Free online charting tools such as Google, Yahoo Finance, etc. report charts using price returns which may be very confusing to the general investing public. They do not take into account the reinvested distributions!

Using your portfolio accounting software or paid tools such as Ycharts and Morningstar can reflect more accurate performance results.

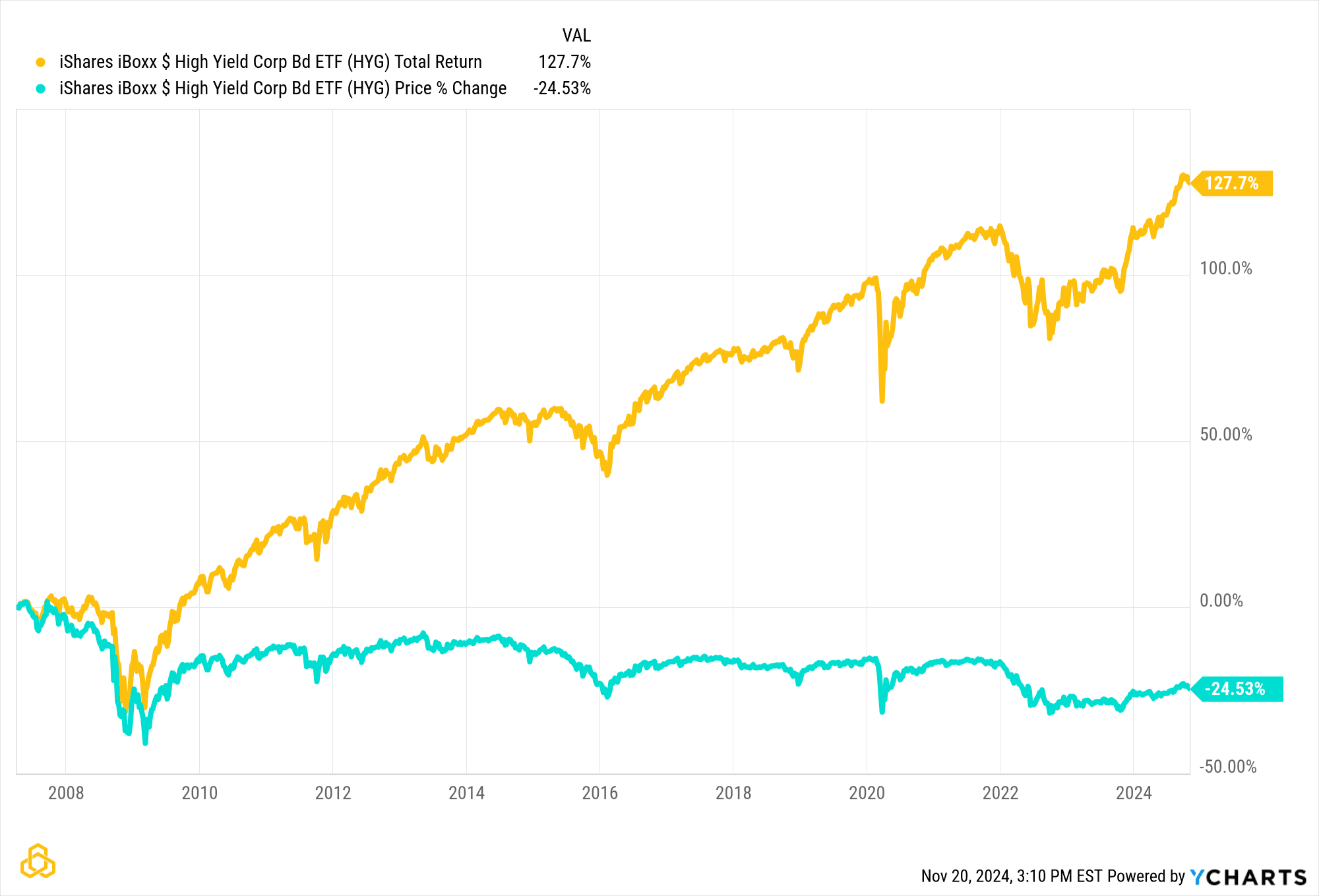

To illustrate the impact of reinvested distributions, consider the following example using Ycharts:

Yellow Line: iShares iBoxx High Yield Corporate Bond ETF (HYG) with distributions reinvested.

Blue Line: Price return only (excludes distributions).

This example demonstrates how total return compares to the price return of a fund. Even though this is an ETF, the math is the same as for a mutual fund. While most ETFs are strategic and do not have distributions, active ETFs can and do have distributions just like mutual funds.

Reinvesting dividends resulted in a total return of 127%, while the price return alone was a -24.53% loss. This shows the importance of including distributions and reinvestment of those distributions into the return calculation.

Why Distribute and When?

Simply put, because it's a regulatory requirement for registered investment companies.

According to the SEC, "The law requires mutual funds and ETFs to distribute any net capital gains on the sale of portfolio securities to shareholders."

In other words, gains from selling underlying holdings must be distributed to shareholders. These payouts can happen at any single time or multiple times a year depending upon the underlying investment, objective, and performance.

Key points

When investing in mutual funds, it's important to understand income distributions, including the types of income distributed, and how these distributions reflect a fund's overall returns. Here are the key takeaways to keep in mind:

Mutual funds distribute two main types of income: dividends and capital

Total return reflects a fund's true performance, including all distributions and reinvestments.

Mutual funds distribute income because regulations for registered investment companies require it.

Capital gain distributions (if applicable) must be paid at least once annually and can happen at any single time or multiple times a year depending upon the underlying investment, objective, and performance.

PFM-626-20241204

Potomac Fund Management (“Potomac”) is an SEC‑registered investment adviser located in Bethesda, Maryland. Registration does not imply a certain level of skill or training, nor is it an endorsement by the SEC. This material is for general informational purposes only and does not constitute investment advice, tax advice, or a recommendation regarding any specific product, security, strategy, or investment decision. Readers should not assume that any discussion or information applies to their individual circumstances. This communication does not constitute an offer to buy or sell any security or a solicitation to provide personalized investment advice for compensation. Nothing herein should be construed as individualized or tailored advice delivered over the internet.

Opinions expressed are current as of the date of publication and may change without notice. Information obtained from third‑party sources is believed to be reliable, but Potomac does not guarantee its accuracy or completeness and is not responsible for any third‑party content referenced or linked in this material.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. For additional important disclosures, please visit potomac.com/disclosures.

Explore our latest insights, watch the “Who Are You?” series.

potomac presents