We are routinely asked why we decided to launch mutual funds in a world that is seemingly brainwashed into thinking that ETFs are the only solution.

There is no doubt that ETFs are a great vehicle and have gained popularity due to their tax efficiency, but they may not always be the best choice for every asset class such as high-turnover tactical strategies. Unlike mutual funds, ETFs trade throughout the day and rely on market makers to manage an operational process that typically minimizes taxable gains.

However, frequent trading on short notice can disrupt this process, leading to taxable events similar to those in mutual funds. Additionally, high-turnover ETFs may experience wider than normal bid/ask spreads and price deviations from their net asset value (NAV).

Potomac’s tactical investment strategies involve frequent trading in a way that could make the ETF structure less advantageous. While future technological advancements may allow strategies like ours to fully benefit from the tax advantages of ETFs, mutual funds remain the most suitable format for Potomac’s approach.

Introduction

The rapid rise in popularity of ETFs has raised concerns among mutual fund investors, primarily due to the tax efficiency ETFs often provide. However, there are specific scenarios where ETFs may not be the ideal choice.

To understand why an ETF might not benefit certain strategies, it’s important to first understand how ETFs operate.

ETF Mechanics

In simple terms, an ETF is an investment that trades on a stock exchange, like an individual stock. Unlike mutual funds, which are priced once per day at the net asset value (NAV), ETFs can be bought and sold throughout the trading day.

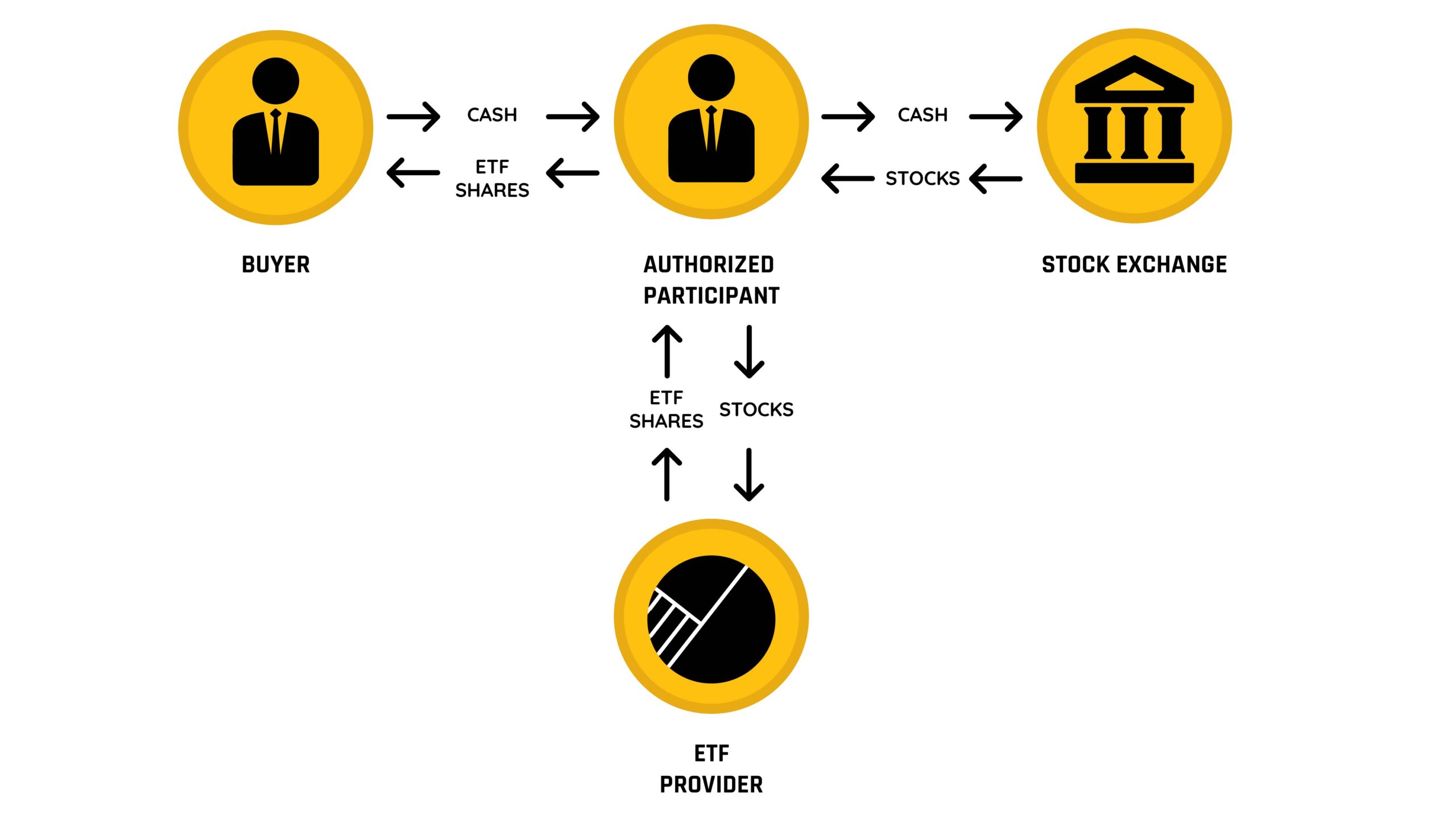

Authorized participants (AP) can create or redeem ETF shares by exchanging them for the actual assets the ETF holds. If the ETF price gets too high or low compared to its NAV, APs can step in to buy or sell, keeping prices in line with NAV.

This is what is referred to as the creation and redemption process. When an AP exchanges assets for shares, it is an in-kind transaction, which avoids triggering capital gains. This is the reason ETFs are potentially, and in most cases, better than mutual funds at reducing the tax burden created by a trading strategy.

The graphic below shows the process visually. An AP buys the holdings of the ETF and delivers those holdings to the ETF provider. The ETF provider then gives shares to the AP, who then sells them back to new ETF buyers.

Source: Kraneshares.com

High Turnover

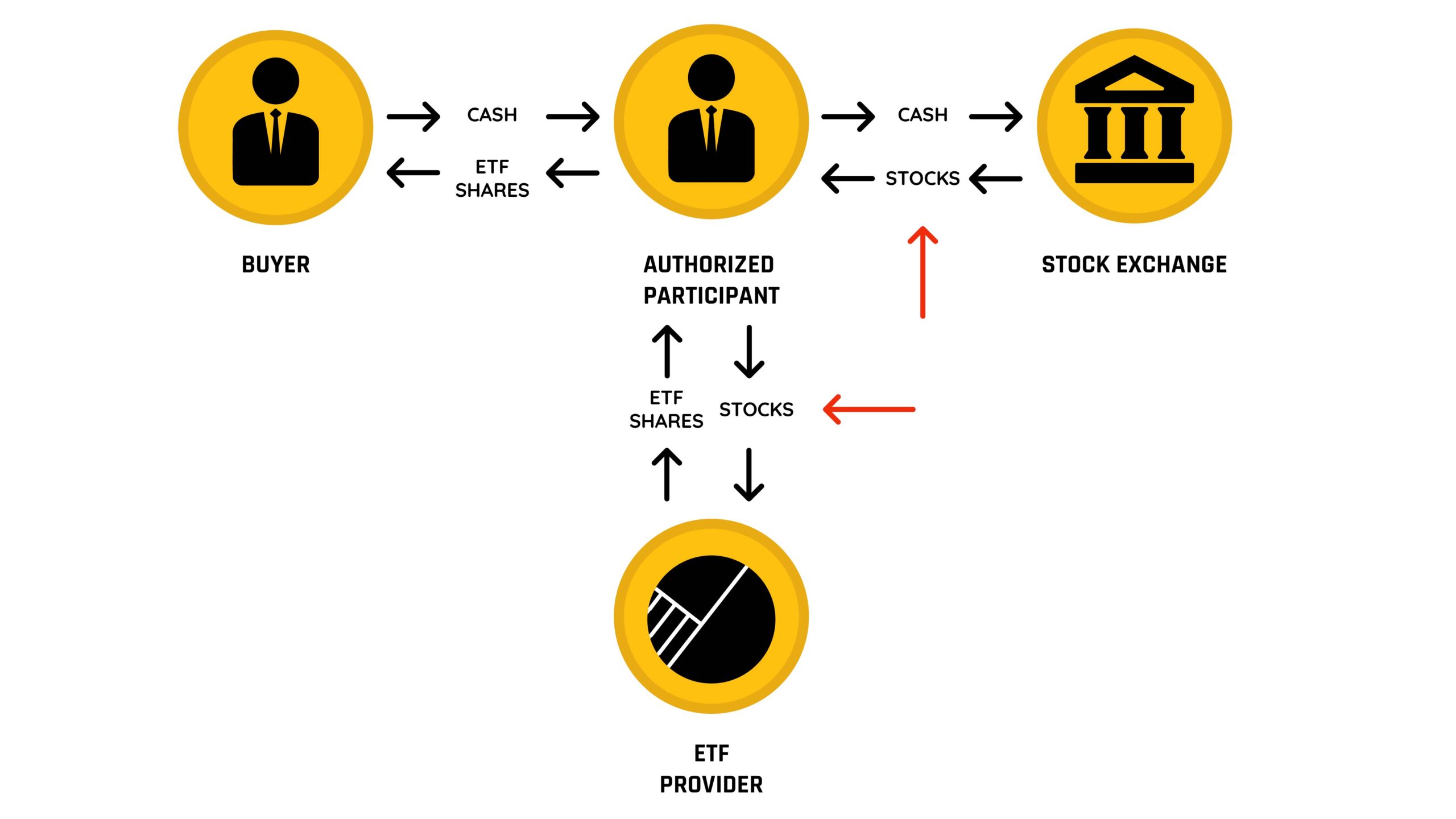

Each time the portfolio changes, APs typically adjust the securities they buy and sell that are delivered to the ETF provider. If the ETF strategy trades on short notice, the APs can struggle to match the shifting holdings, reducing the effectiveness of this process, which is the primary tax advantage of an ETF.

Below is the same graphic, with red arrows pointing to the steps that would be problematic should a strategy trade frequently. The securities to purchase would be unknown, and the APs wouldn’t have the correct holdings to deliver to the ETF provider.

Source: Kraneshares.com

In some cases, like this, ETFs may be forced to use a combination of cash redemptions and in-kind transactions because they don’t know what the underlying ETF holdings are that they need to purchase and deliver to the ETF provider.

This can turn what is typically a tax-efficient vehicle into one that distributes taxable gains, much like a traditional mutual fund.

Potomac Strategies in an ETF

The composite model we use to drive most investment decisions is reliant on being able to adapt to new data every day. As explained, executing fast-moving strategies in an ETF can cause issues.

If our model is on a buy today, and tomorrow we sell at a profit, the authorized participants will not always be able to take advantage of the potential tax mitigation within an ETF because they don’t have prior notice of the trade. This makes it less tax efficient than if they had sufficient notice of the trade beforehand.

Because our model trades in this way, an ETF wouldn’t be much different than a mutual fund. In fact, it could be worse because with a mutual fund, the NAV is updated daily, and shares are traded at that price without a bid/ask spread.

In an ETF, the market makers and other parties would be unsure if we were going to buy or sell, and because of this, the ETF could have a wider than normal bid/ask spread.

In addition to the wide bid/ask spread, the traded price of the ETF could deviate from the true NAV of the fund. This is called trading at a premium or discount and is in contrast to mutual funds where you trade at NAV every time without a premium or discount.

Why File ETF as a Share Class?

To address why we filed for an ETF as a share class, there is a simple answer: things can change.

By the time the share class could be approved, the technology behind ETFs could adapt to accommodate faster trading strategies like ours.

If that’s the case, we want to be prepared to offer clients the investment vehicle that is best for them, which at the moment is the traditional mutual fund wrapper.

Wrap up

ETFs are, according to many, the way of the future. However, there are operational constraints in place today which make it problematic to operate truly tactical strategies in that wrapper.

There are three main reasons why we believe mutual funds are still the best format for Potomac strategies:

- Tactical trading on short notice can reduce the tax efficiency of ETFs.

- Uncertainty of underlying holdings can create wider than normal bid/ask spread

- Premium/Discounts can become wide relative to NAV.

Potomac Fund Management ("Potomac") is an SEC-registered investment adviser. SEC registration does not constitute an endorsement of the advisory firm by the SEC nor does it indicate that the advisory firm has attained a particular level of skill or ability. This information is prepared for general information only and should not be considered as individual investment advice nor as a solicitation to buy or offer to sell any securities. This material does not constitute any representation as to the suitability or appropriateness of any investment advisory program or security. Please visit our FULL DISCLOSURE page. Potomac does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to the Potomac website or incorporated herein, and takes no responsibility for any of this information. The views of Potomac are subject to change and Potomac is under no obligation to notify you of any changes. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable or equal to any historical performance level.

PFM-601-20250321