By

Dan Russo

•

Feb 2, 2026

Deceptive Weakness

Dan Russo, CMT

February 2, 2026

There are some weaknesses in the market—but it’s deceptive. You must know where to look, and it’s not where EVERYONE else is looking. As we discussed last week, the shifts are subtle, but they’re there.

At the same time, February has historically been a friendly month for investors. Still, for the first time in a while, the pressure is on the bulls. It’s officially “show me” time.

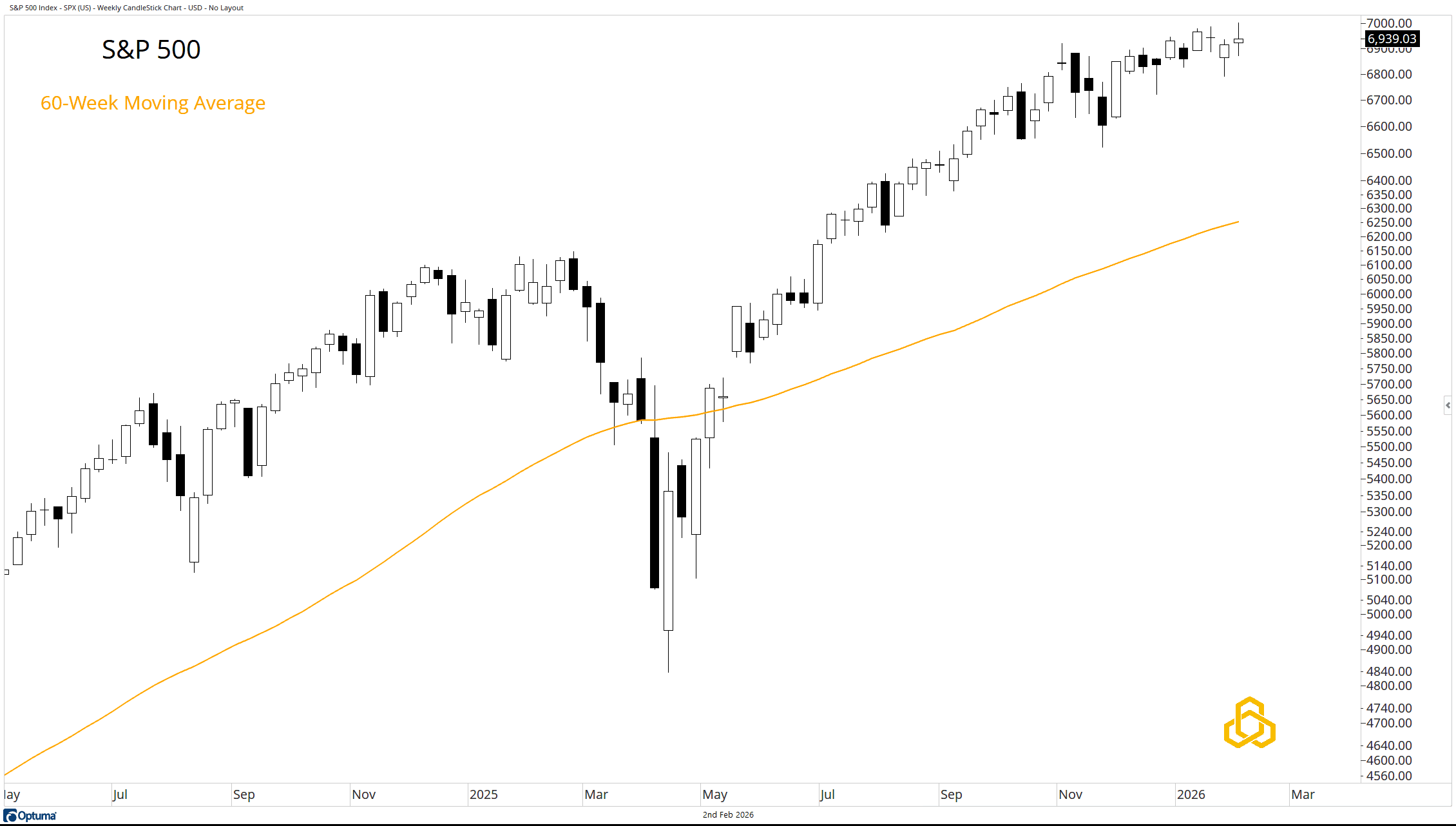

S&P 500

The S&P 500 hit a new high last week, so it’s understandable that many investors weren’t actively hunting for signs of weakness. Admittedly, I wouldn’t normally be overly concerned with cracks beneath the surface when a major index is trading at record levels.

Ideally, we like to see breakouts stick—but the fade that followed wasn’t particularly damaging either. The index remains well above the 60-week moving average.

Source: Optuma

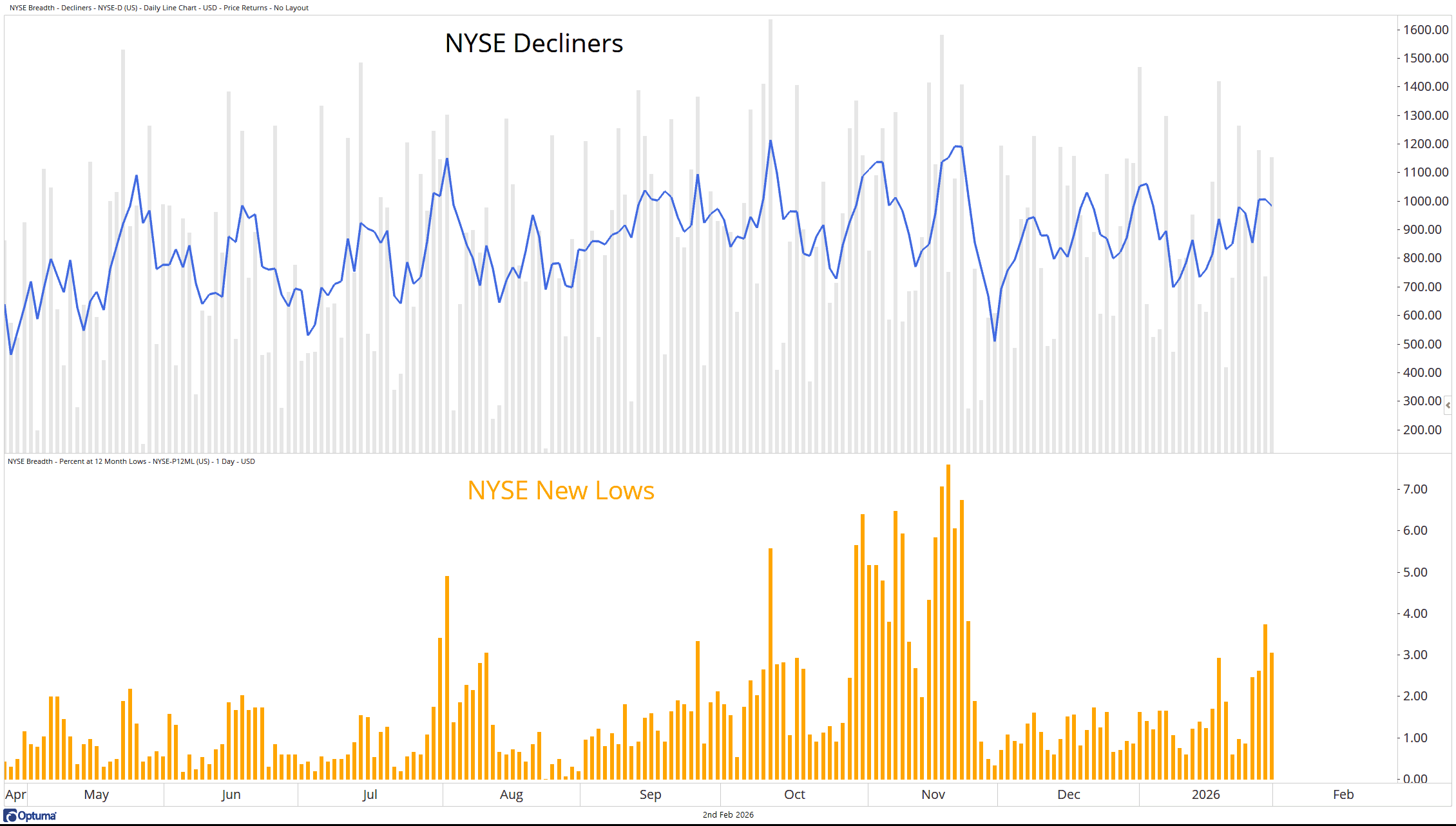

Decliners and New Lows

This chart makes an appearance for the second consecutive week, so regular readers should have a growing sense of what’s happening beneath the surface. The five-day moving average of decliners continues to drift higher—slowly, but unmistakably.

At the same time, new lows are still expanding.

Source: Optuma

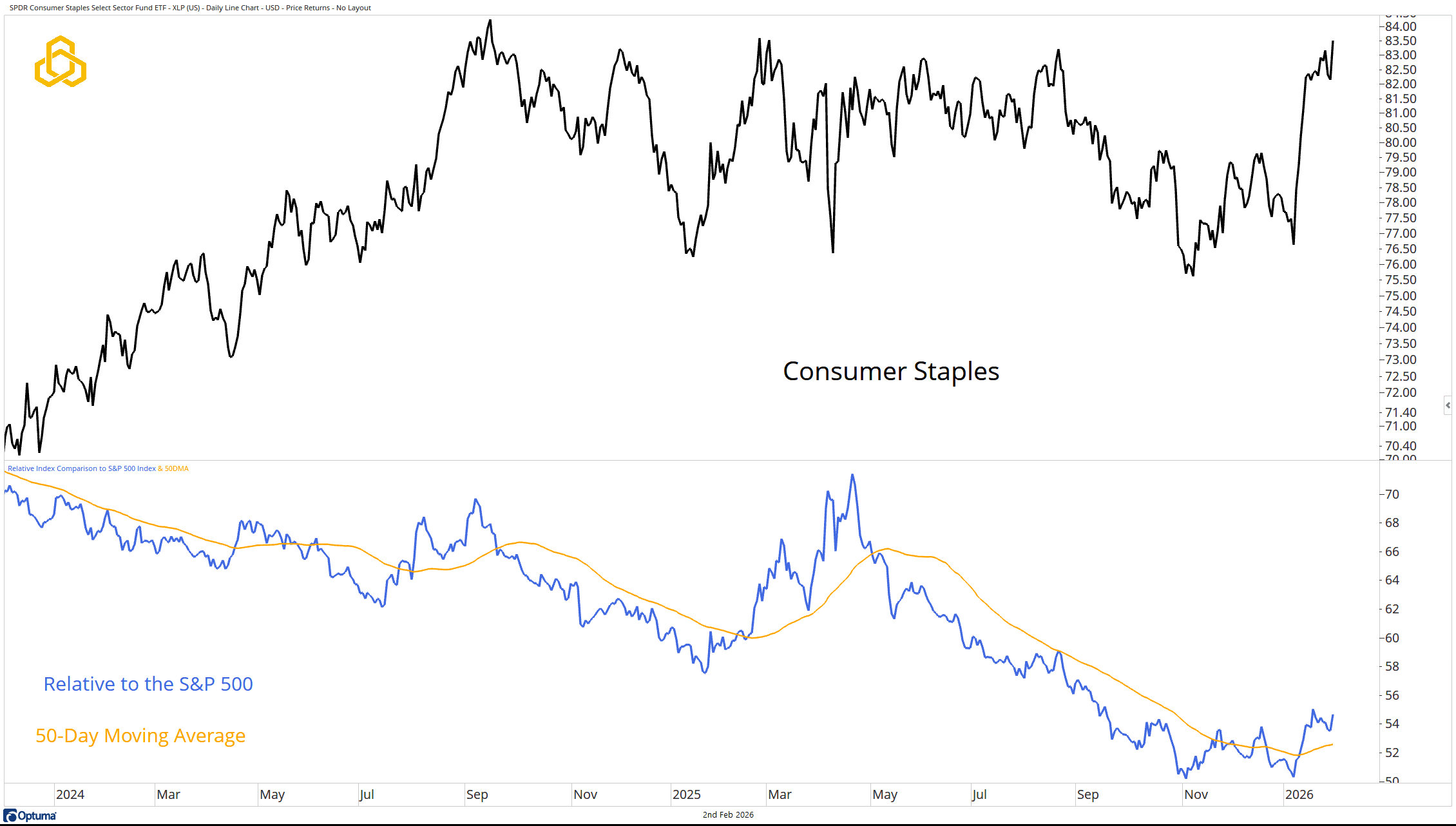

Consumer Staples

This group may not be on many radars—and understandably so, given that Consumer Staples make up less than 6% of the S&P 500. Still, the sector is quietly pressing up against record highs and has outperformed the broader index year-to-date.

Notably, the relative ratio has reclaimed its 50day moving average after successfully holding the November 2025 lows. And let’s be clear—Staples are not typically known as the “offensive” players in the market.

Source: Optuma

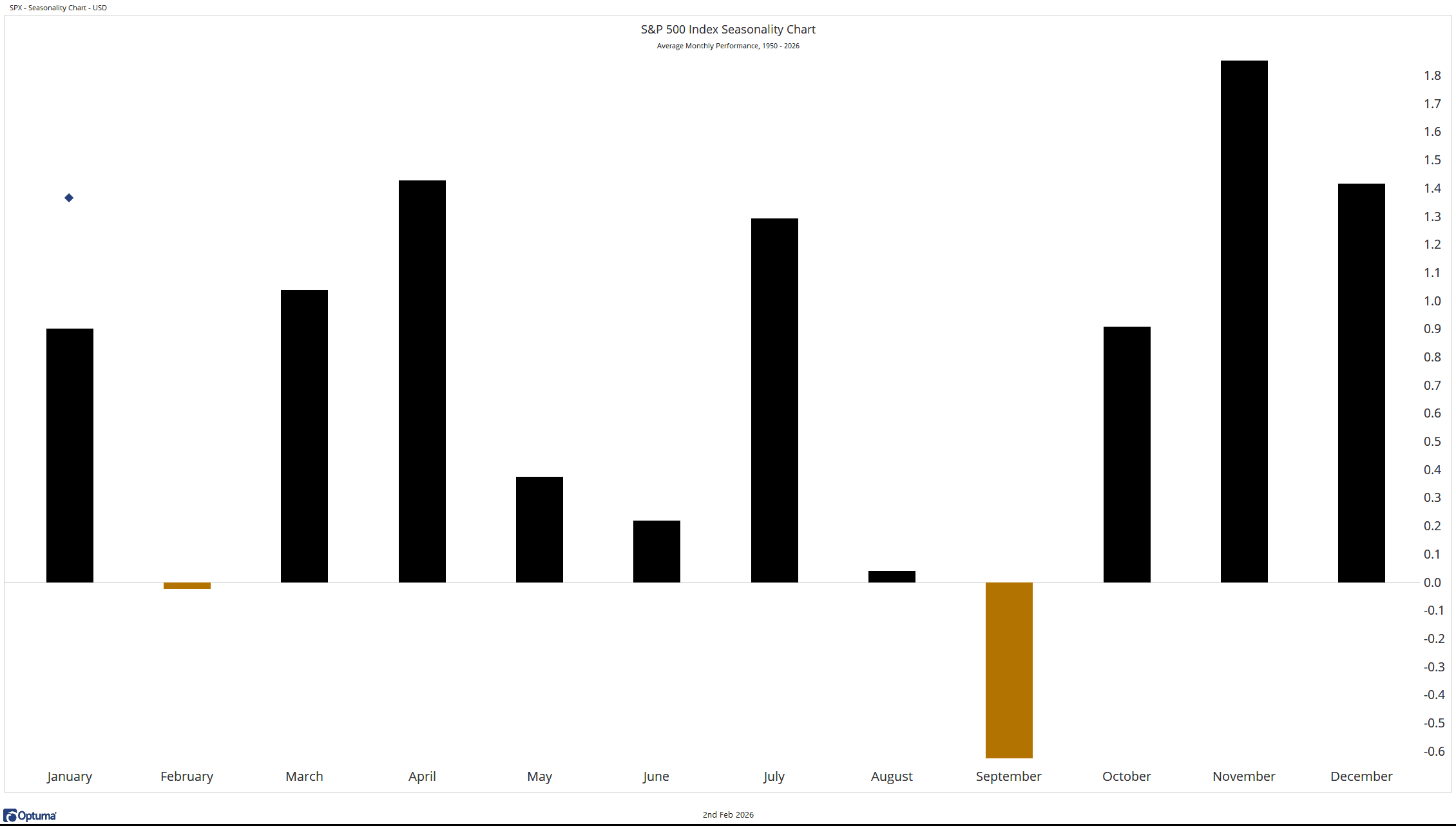

Monthly Seasonality

Another underappreciated fact: February is one of just two months that has posted negative average returns for the S&P 500 since 1950.

Source: Optuma

Silver and Gold

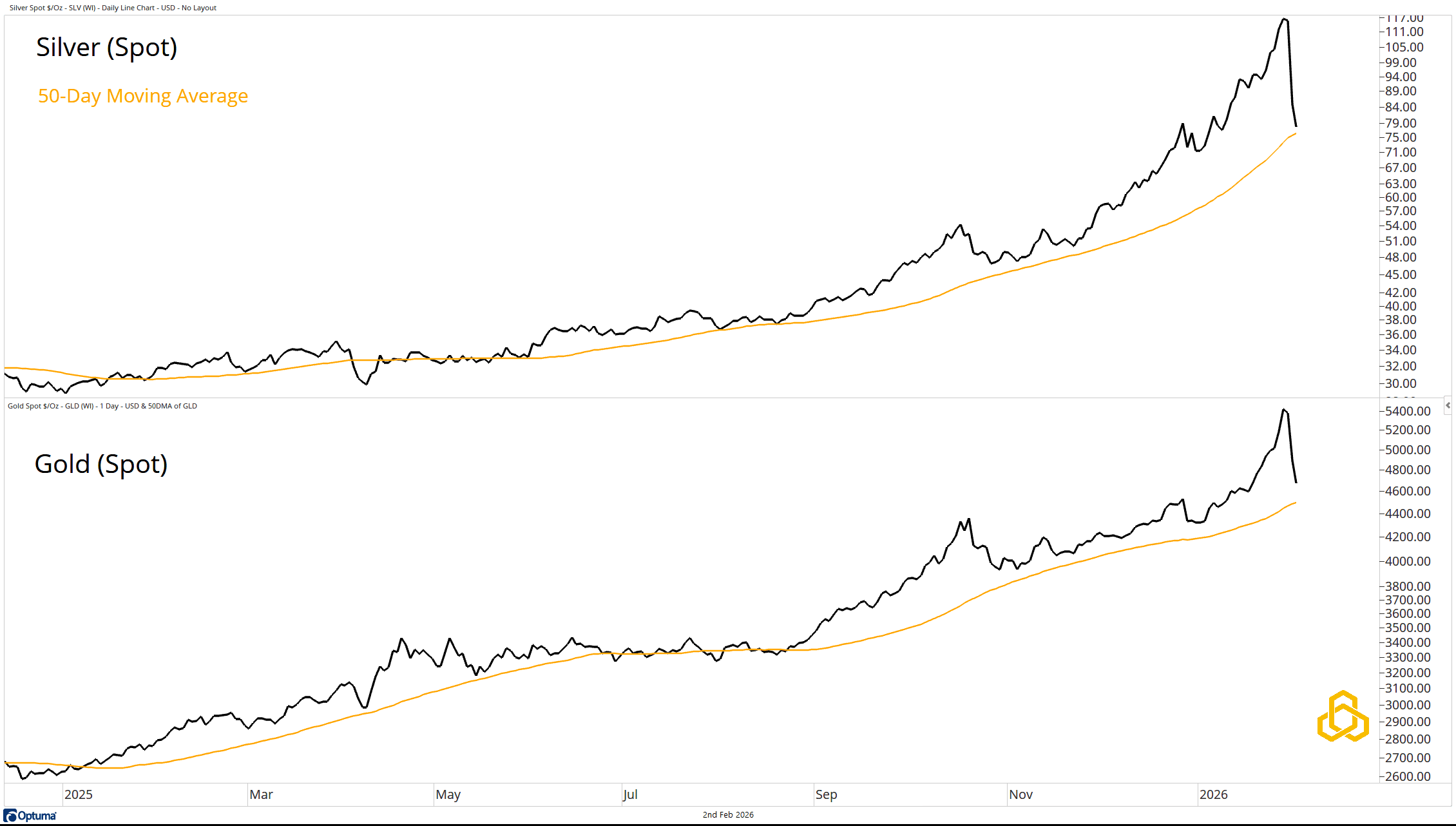

Since everyone else is talking about it, we’ll mention it too—mainly because it’s likely why many investors have missed the more subtle weakness highlighted above.

There’s no need to belabor the point. Gold and silver are simply correcting parabolic moves. Both are nearing their respective 50-day moving averages, which is a logical area for buyers to step back in. We shall see. Source: Optuma

Source: Optuma

Final Thoughts

The market isn’t breaking—but it is quietly changing its character. New highs at the index level mask increasing participation from defensive areas, a slow creep higher in decliners, and expanding new lows beneath the surface. None of this is decisive on its own, but together it’s enough to warrant attention.

This is not a call to get bearish. It is a reminder that bull markets don’t run on autopilot forever. February has historically been less forgiving, and the burden of proof now sits with the bulls.

For now, the weakness is deceptive.

PFM-20260202

Standard Disclosures

Potomac Fund Management (“Potomac”) is an SEC‑registered investment adviser located in Bethesda, Maryland. Registration does not imply a certain level of skill or training, nor is it an endorsement by the SEC. This material is for general informational purposes only and does not constitute investment advice, tax advice, or a recommendation regarding any specific product, security, strategy, or investment decision. Readers should not assume that any discussion or information applies to their individual circumstances. This communication does not constitute an offer to buy or sell any security or a solicitation to provide personalized investment advice for compensation. Nothing herein should be construed as individualized or tailored advice delivered over the internet.

Opinions expressed are current as of the date of publication and may change without notice. Information obtained from third‑party sources is believed to be reliable, but Potomac does not guarantee its accuracy or completeness and is not responsible for any third‑party content referenced or linked in this material.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. For additional important disclosures, please visit potomac.com/disclosures.

Explore our latest insights, watch the “Who Are You?” series, or subscribe to our blog

potomac presents