By

Dan Russo

•

Feb 9, 2026

I Get by With a Little Help from My Friends

Dan Russo, CMT

February 9, 2026

Last week’s deceptive weakness failed to spill over into the broader market. In fact, the market shrugged it off completely and strengthened. The title of this week’s note speaks to the reality that the NASDAQ 100 and the S&P 500 are getting by with the help of almost everything else (those of a certain vintage may recognize the title from other places).

The question for the bulls is simple: how long can the rest of the market carry an elephant on its back? Because that’s exactly what’s happening right now. For the moment, they’re getting away with it.

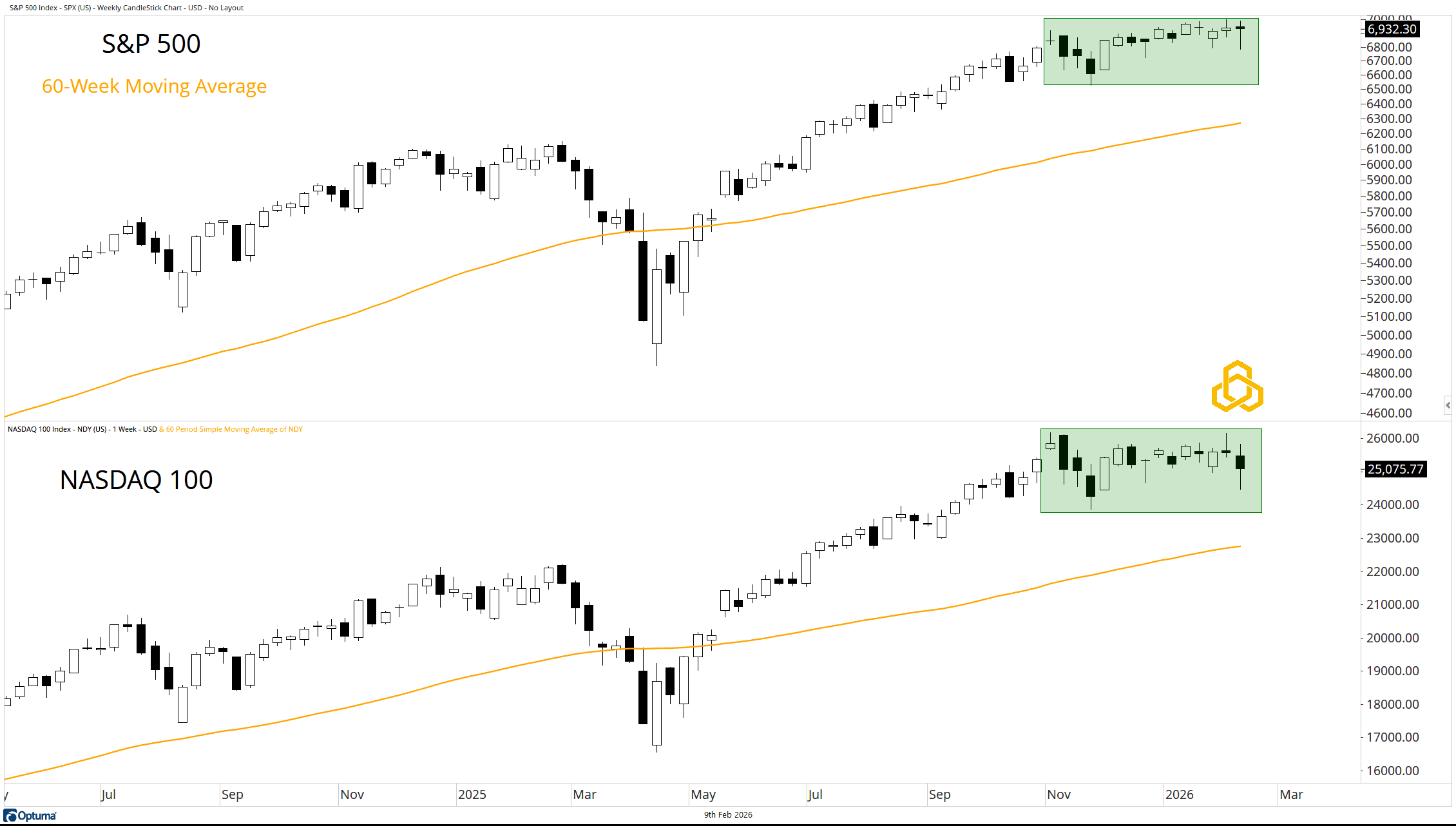

S&P 500 and NASDAQ 100

The elephants in question are the two major U.S. averages (yes, I know the Dow hit 50,000 on Friday—but it’s a 30 stock, price weighted index, so I don’t put it in the same class as these).

The S&P 500 and the NASDAQ 100 remain above their respective 60-week moving averages. However, neither index has made meaningful progress since October 2025.

Source: Optuma

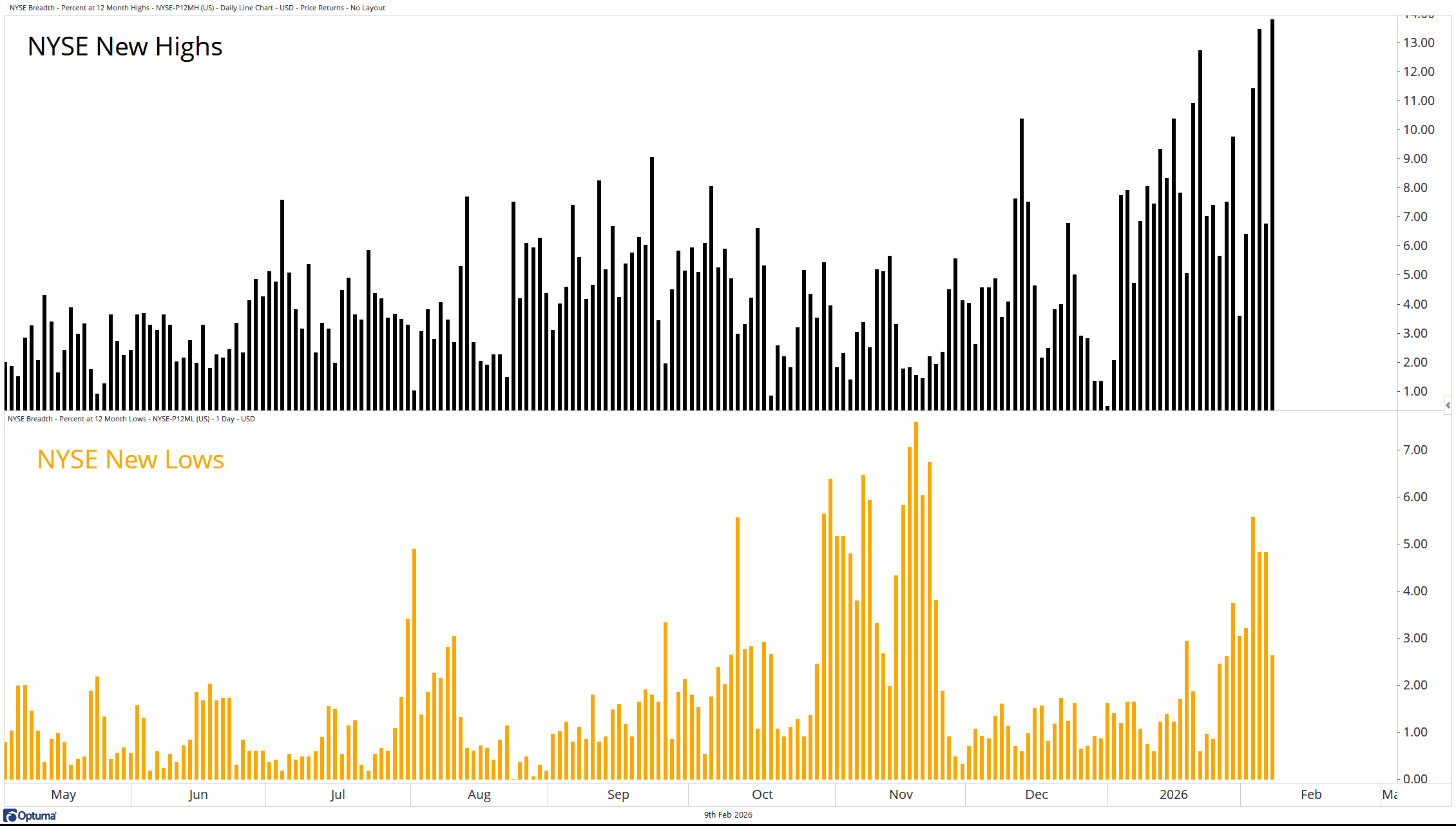

NYSE New Highs and New Lows

The first “friend” doing some heavy lifting is the NYSE New Highs list. Recall that we’ve been highlighting an expansion in new lows. At the same time, we’re seeing an explosion higher in new highs.

That combination is helping the bulls keep control—for now.

Source: Optuma

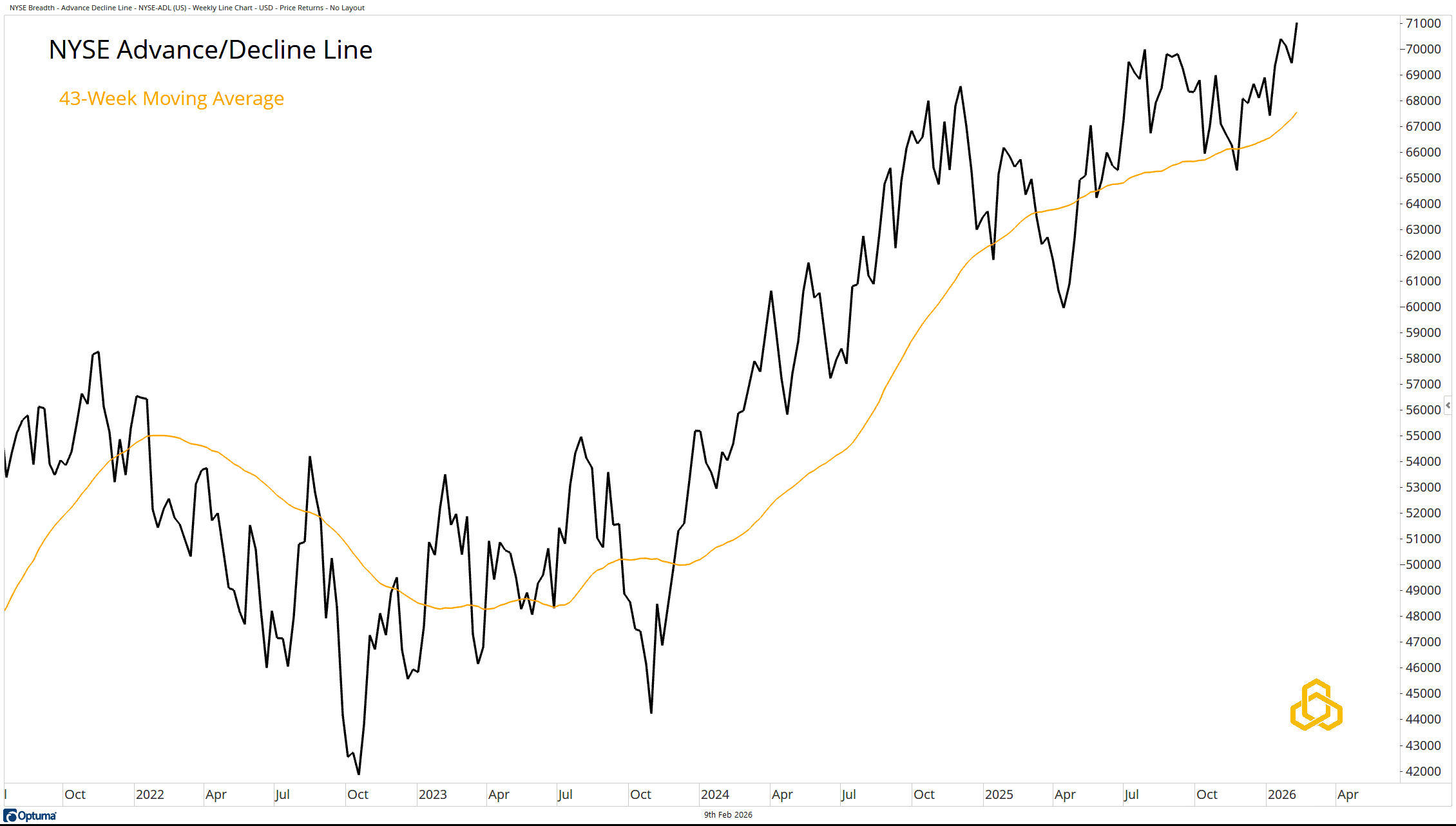

NYSE Advance / Decline Line

The second strong friend is the NYSE Advance/Decline Line. It’s trading above its 43-week moving average and broke out to a new high last week.

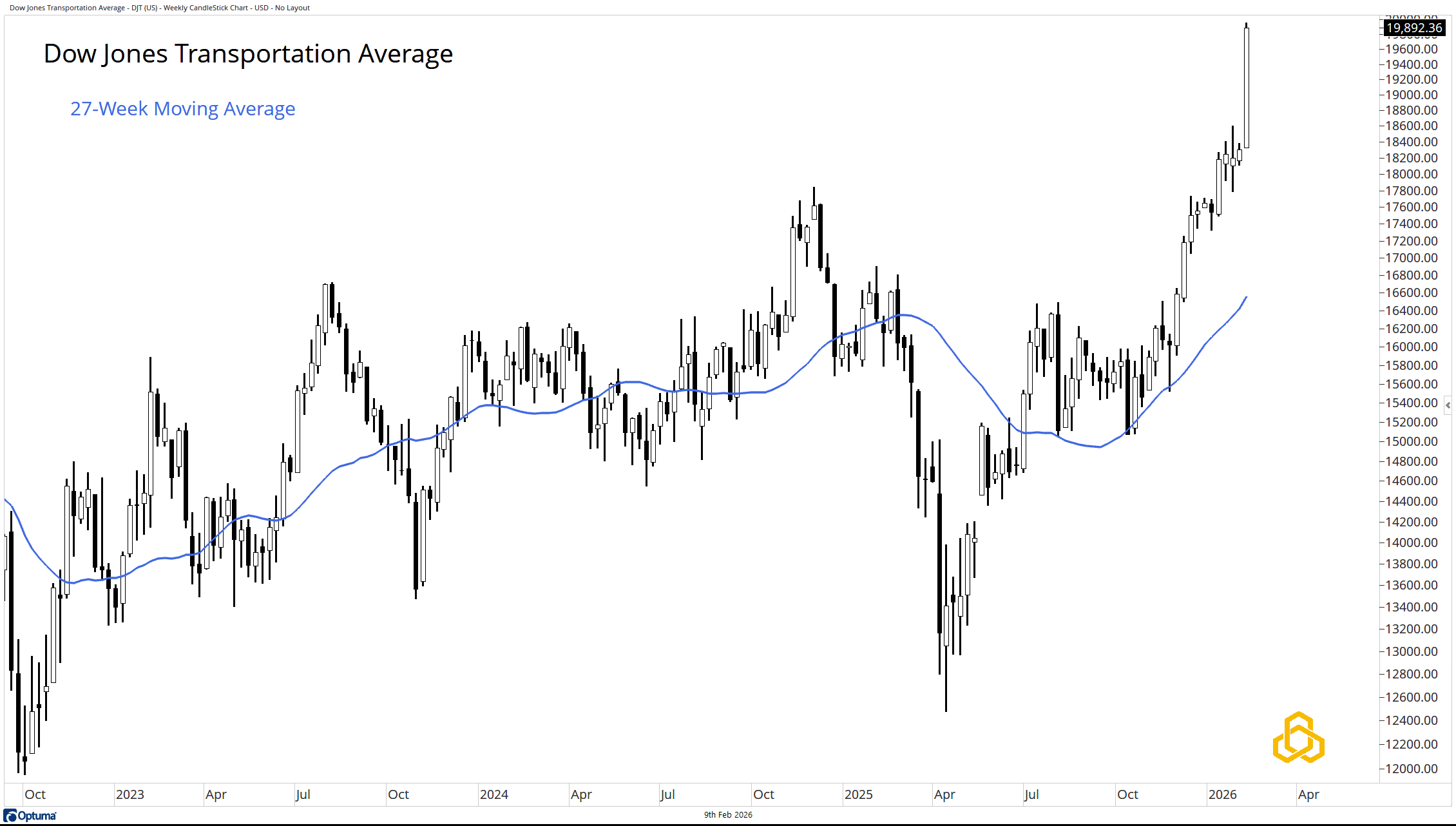

Dow Jones Transportation Average

The strongest powerlifter in the group remains the Transports. The average is well above its rising 27-week moving average. It’s hard to make a compelling bearish argument when the Transports look like this.

Source: Optuma

International

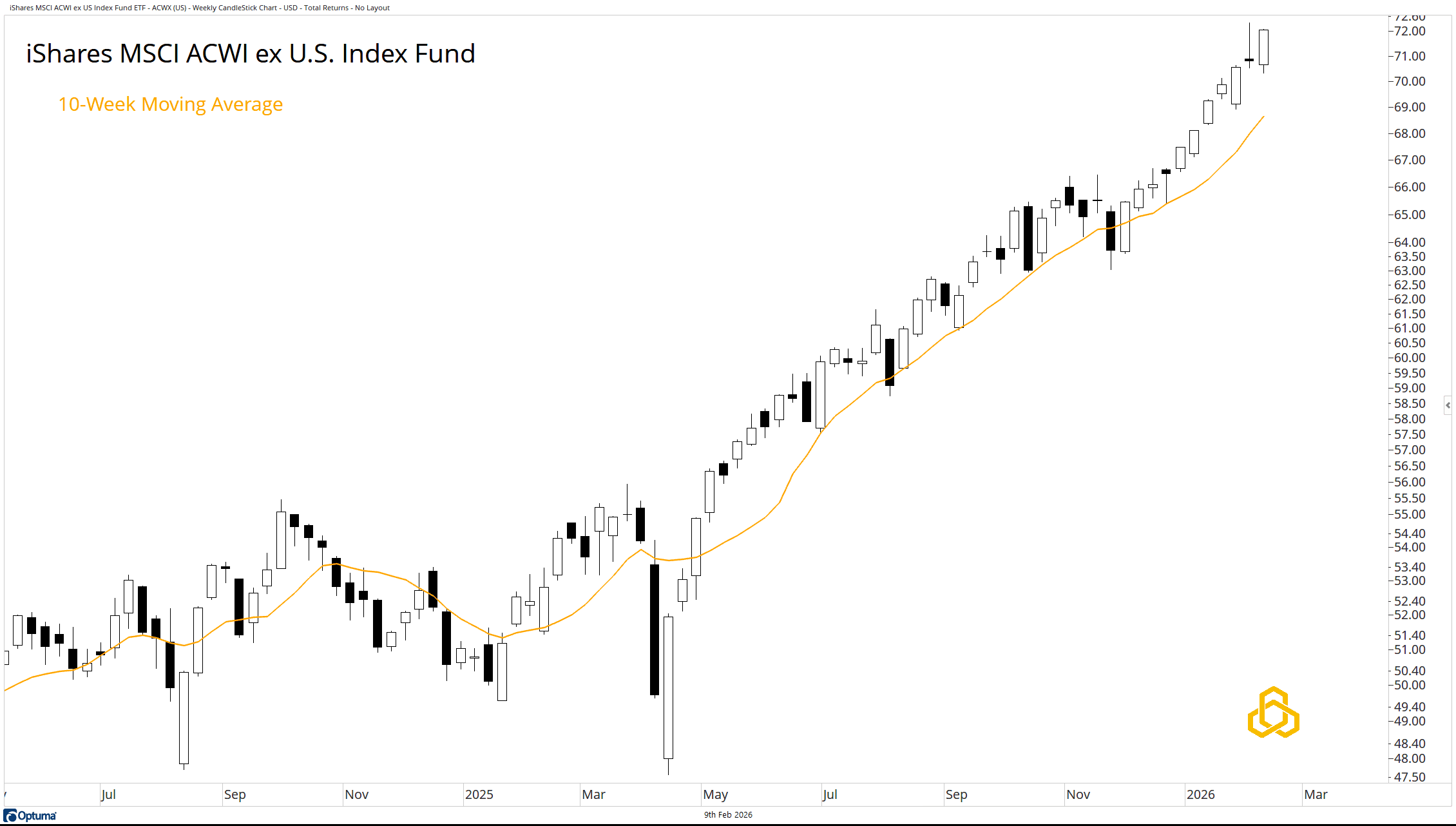

Let’s not forget the support coming from international markets. The iShares MSCI ACWI ex U.S. Index Fund put in a strong rebound above its rising 10 week moving average.

Source: Optuma

Final Thoughts

The major U.S. averages are treading water—but they’re not breaking down because nearly everything else is holding them up. That speaks to broadening participation across the market.

The open question is how long the smaller players can keep carrying the elephant. For now, they’re doing the job—and doing it well.

PFM-307-20260209

Standard Disclosures

Potomac Fund Management (“Potomac”) is an SEC‑registered investment adviser located in Bethesda, Maryland. Registration does not imply a certain level of skill or training, nor is it an endorsement by the SEC. This material is for general informational purposes only and does not constitute investment advice, tax advice, or a recommendation regarding any specific product, security, strategy, or investment decision. Readers should not assume that any discussion or information applies to their individual circumstances. This communication does not constitute an offer to buy or sell any security or a solicitation to provide personalized investment advice for compensation. Nothing herein should be construed as individualized or tailored advice delivered over the internet.

Opinions expressed are current as of the date of publication and may change without notice. Information obtained from third‑party sources is believed to be reliable, but Potomac does not guarantee its accuracy or completeness and is not responsible for any third‑party content referenced or linked in this material.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. For additional important disclosures, please visit potomac.com/disclosures.

Explore our latest insights, watch the “Who Are You?” series, or subscribe to our blog

potomac presents