By

Dan Russo

•

Jan 26, 2026

This Gives Us Pause

Dan Russo, CMT

January 26, 2026

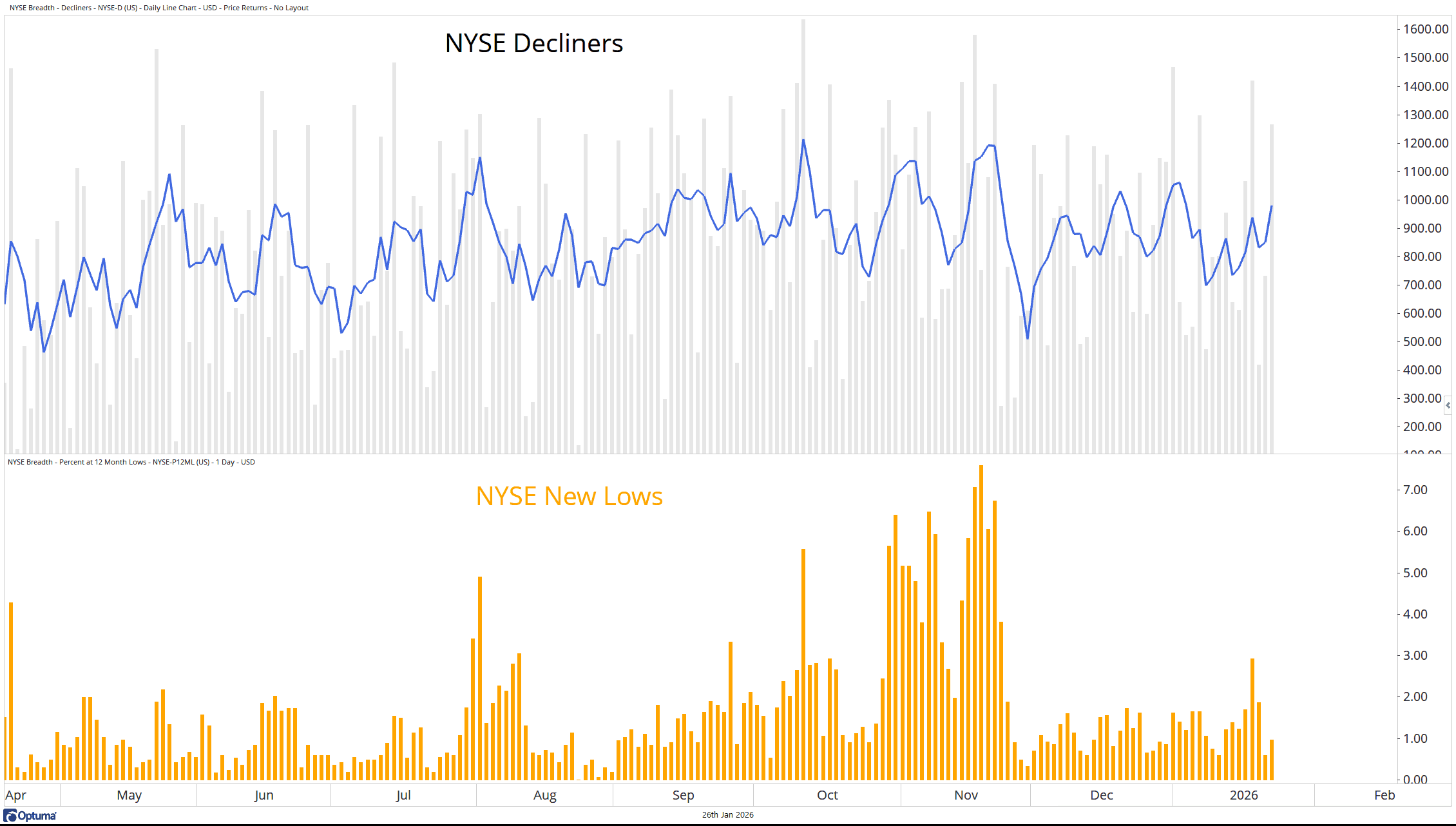

The S&P 500 closed lower for a second consecutive week, while the NASDAQ 100 remains in the consolidation zone we’ve been highlighting here. There has been a small uptick in new lows on the NYSE over the past week. At the same time, the five-day moving average of decliners on the NYSE has reached its highest level of 2026.

To be clear, these are minor and early shifts. They can easily reverse, but for now, they merit attention.

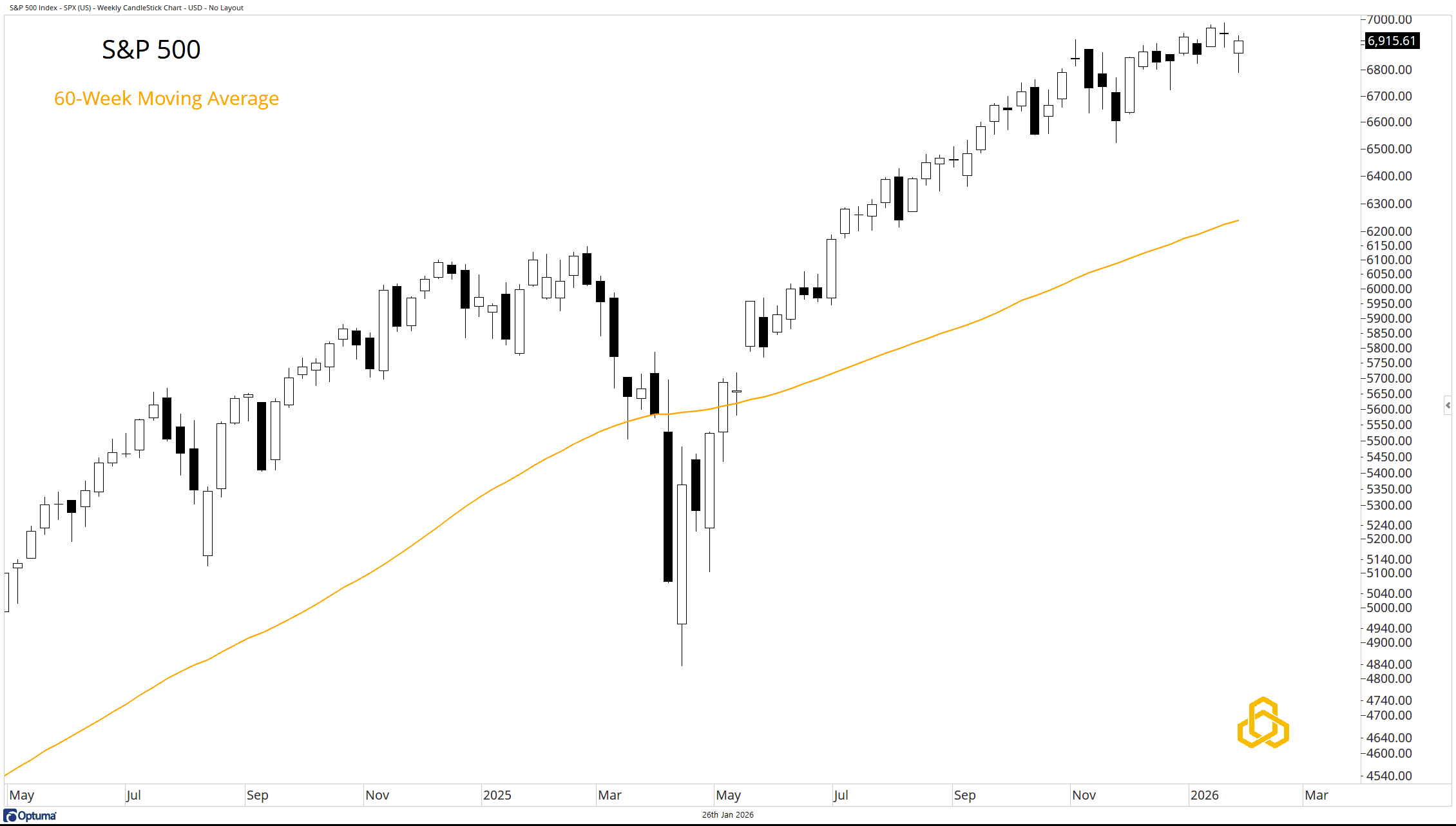

S&P 500

The closely watched index moved lower for a second straight week but remains well above a steadily rising 60-week moving average. Is this enough to cause concern? Absolutely not. But we want to see the weakness bought quickly.

Source: Optuma

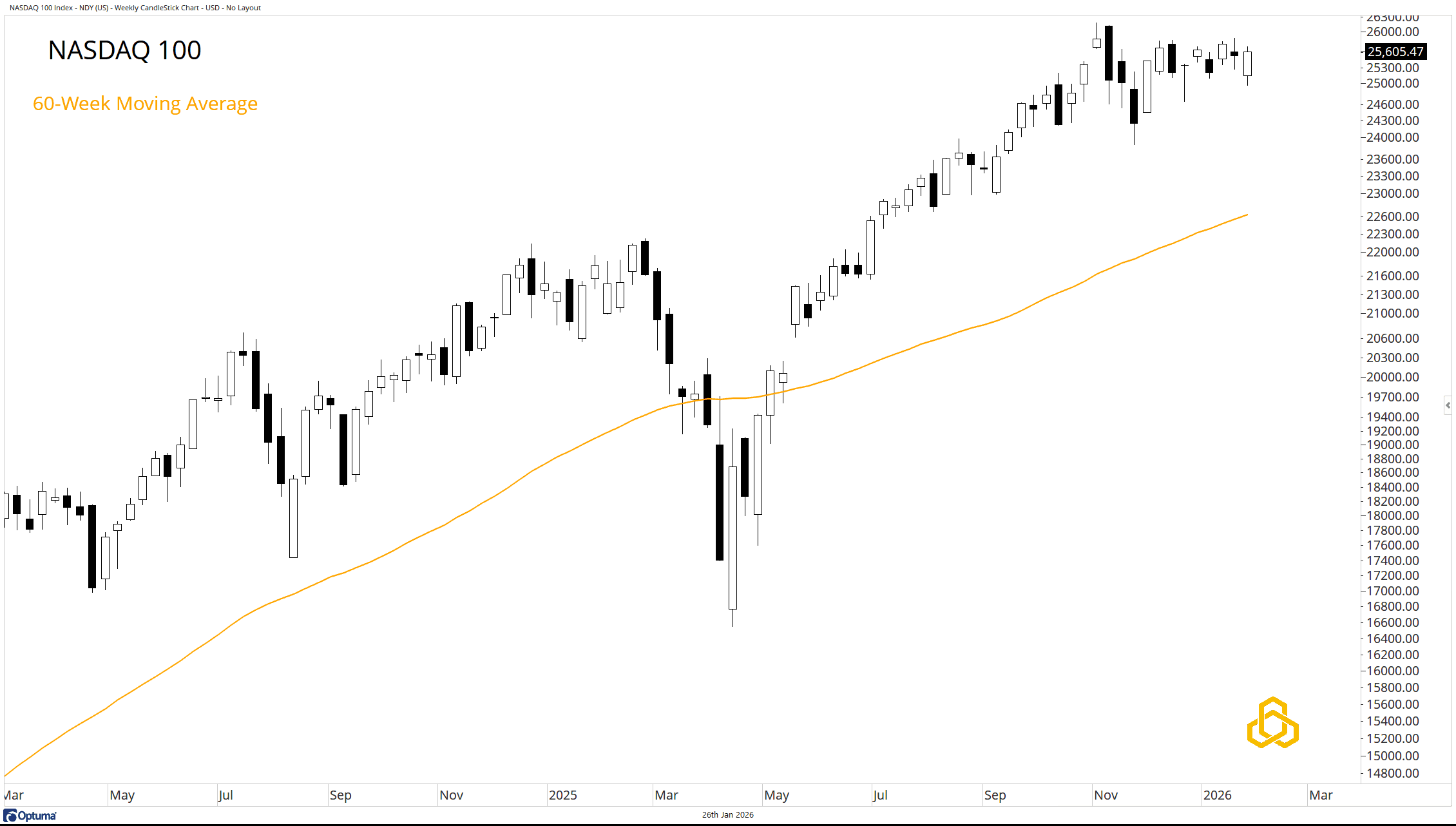

NASDAQ 100

The NASDAQ 100 delivered a largely flat performance last week and remains in consolidation above its rising long-term moving average. Here too, there’s no major cause for concern—just an acknowledgment that little progress has been made for nearly three months.

Odds still favor a pause rather than something more sinister.

Source: Optuma

NYSE Decliners and New Lows

While the price action highlighted above is not concerning on its own, we are mindful that last week saw an increase in both the number of decliners (five-day moving average, in blue) and the number of new lows on the NYSE.

These are subtle shifts. The best outcome would be a quick reversal. However, continued deterioration here would justify further caution.

Source: Optuma

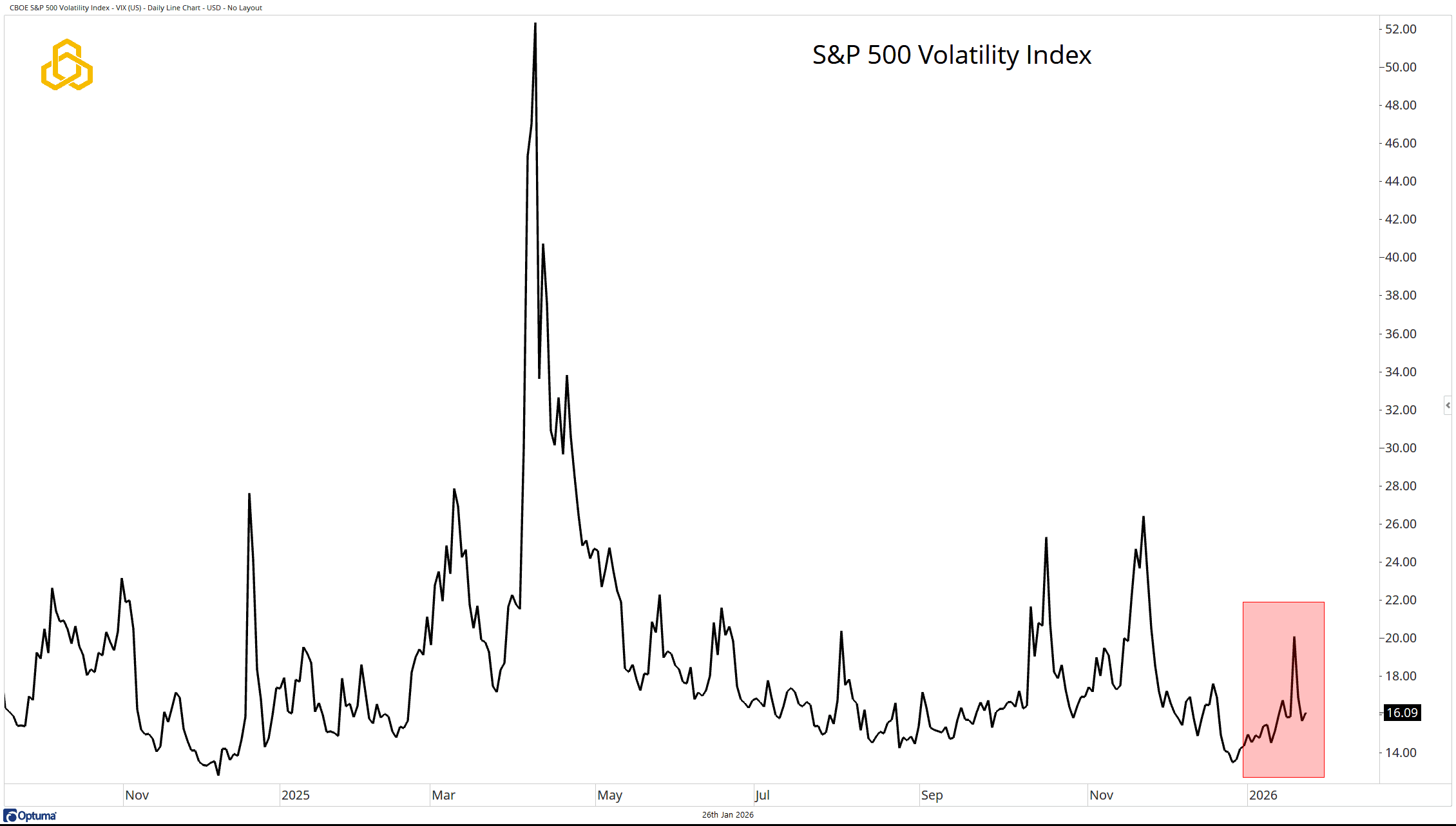

Volatility

On the positive side, there has been no sustained or meaningful spike in volatility. That said, volatility has been trending higher so far in 2026 and, the move is subtle—but it’s there.

Source: Optuma

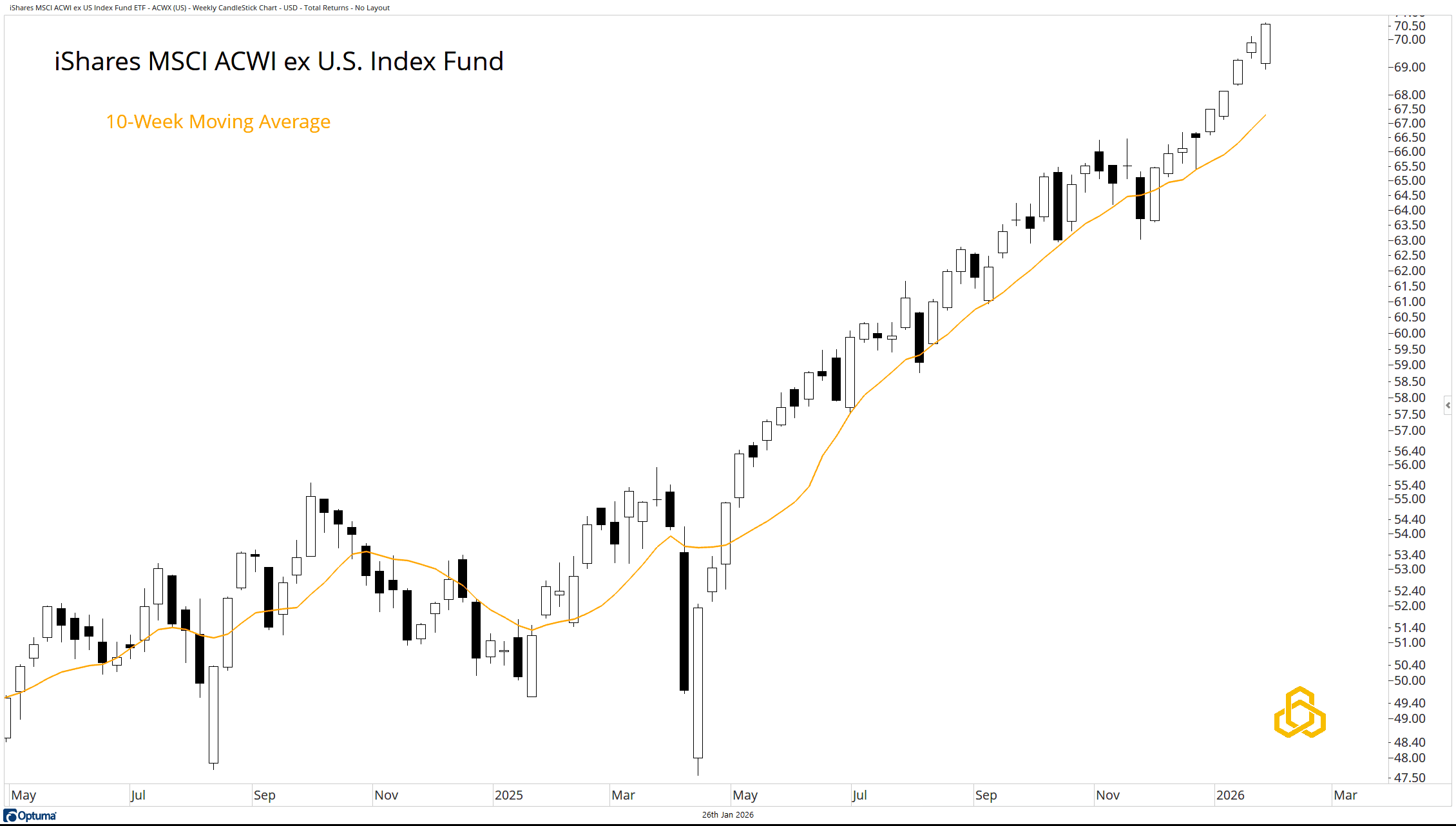

Rest of the World

It’s possible that investors are simply reallocating capital outside the U.S. The iShares MSCI ACWI ex U.S. Index Fund closed higher for a ninth consecutive week and continues to trade well above its rising 10-week moving average.

Source: Optuma

Final Thoughts

The primary trend remains intact, and nothing here suggests the market is breaking down. That said, some internal governor indicators are starting to lean less supportive in the very short term, and that earns our attention.

These are early signals, not conclusions. Ideally, we see decliners, new lows, and volatility fade quickly, reinforcing the idea that this is just another pause within a broader uptrend. If that happens, the bull case remains firmly in place.

PFM-305-20260126

Potomac Fund Management (“Potomac”) is an SEC‑registered investment adviser located in Bethesda, Maryland. Registration does not imply a certain level of skill or training, nor is it an endorsement by the SEC. This material is for general informational purposes only and does not constitute investment advice, tax advice, or a recommendation regarding any specific product, security, strategy, or investment decision. Readers should not assume that any discussion or information applies to their individual circumstances. This communication does not constitute an offer to buy or sell any security or a solicitation to provide personalized investment advice for compensation. Nothing herein should be construed as individualized or tailored advice delivered over the internet.

Opinions expressed are current as of the date of publication and may change without notice. Information obtained from third‑party sources is believed to be reliable, but Potomac does not guarantee its accuracy or completeness and is not responsible for any third‑party content referenced or linked in this material.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. For additional important disclosures, please visit potomac.com/disclosures.

Explore our latest insights, watch the “Who Are You?” series, or subscribe to our blog

potomac presents