By

Shawn Snyder

•

Introducing the Potomac Beltway Brief, Potomac’s new weekly pulse check on the forces shaping the markets from right here in Washington DC’s backyard. With policy shifts, economic data, and political noise often colliding just miles from our office, we’ll cut through the clutter and highlight what matters for advisors and their clients.

Each week, you’ll get a concise, actionable look at the trends moving the economy and the potential impact on markets, so you can stay ahead of the narrative instead of reacting to it.

The Potomac Beltway Brief: The Warsh Reality

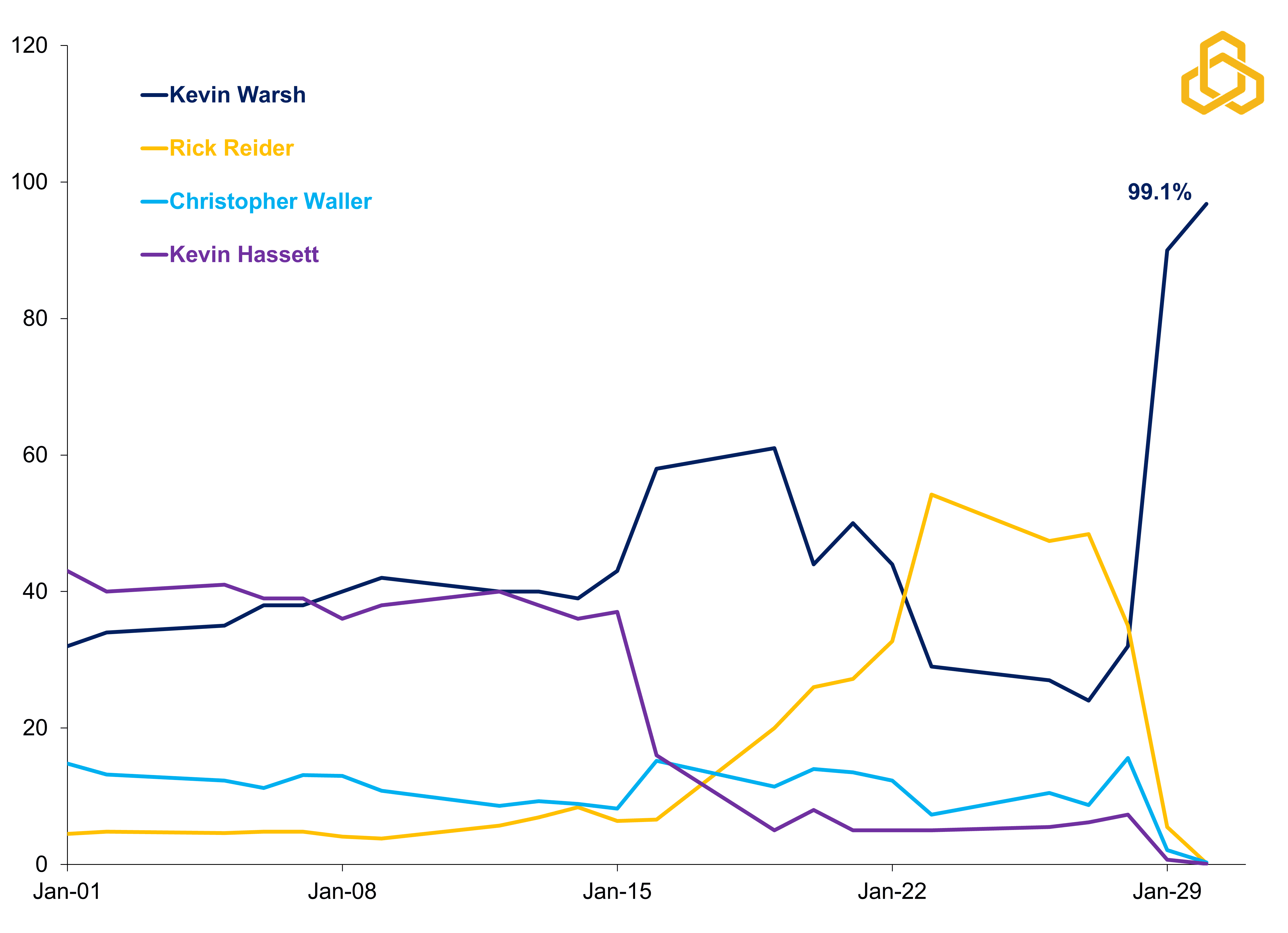

The nomination of Kevin Warsh to lead the Federal Reserve, announced by President Trump on January 30, 2026, was largely expected (see figure 1). And yet, investors in hard assets like gold and silver were caught off guard with both precious metals dropping sharply following the news. Why did something expected cause such an unexpected shockwave?

Figure 1. Probabilities of Who President Trump will Nominate as Fed Chair (%)

Sources: Polymarket.com, Bloomberg L.P. and Potomac. Data as of January 30, 2026. All forecasts are expressions of opinions and are subject to change without notice and are not intended to be a guarantee.

Who is Kevin Warsh?

At 55, Warsh is a veteran of the Federal Reserve, having served as its youngest-ever Governor from 2006 to 2011. A former economic advisor to the George W. Bush Administration, he is respected for his role as the Fed’s primary liaison to Wall Street during the 2008 Global Financial Crisis.

Despite President Trump’s call for lower interest rates, Warsh is considered a "hawk” regarding the Fed’s footprint. He has frequently criticized the Fed’s use of the balance sheet for massive bond-buying programs. In a May 2025 speech at the Hoover Institution, Warsh summarized his view:

“If we would run the printing press a little quieter, we could then have lower interest rates because what we're doing right now is we have all this money that's being flooded into the system which causes inflation to be above target.”

The Warsh “Shockwave”

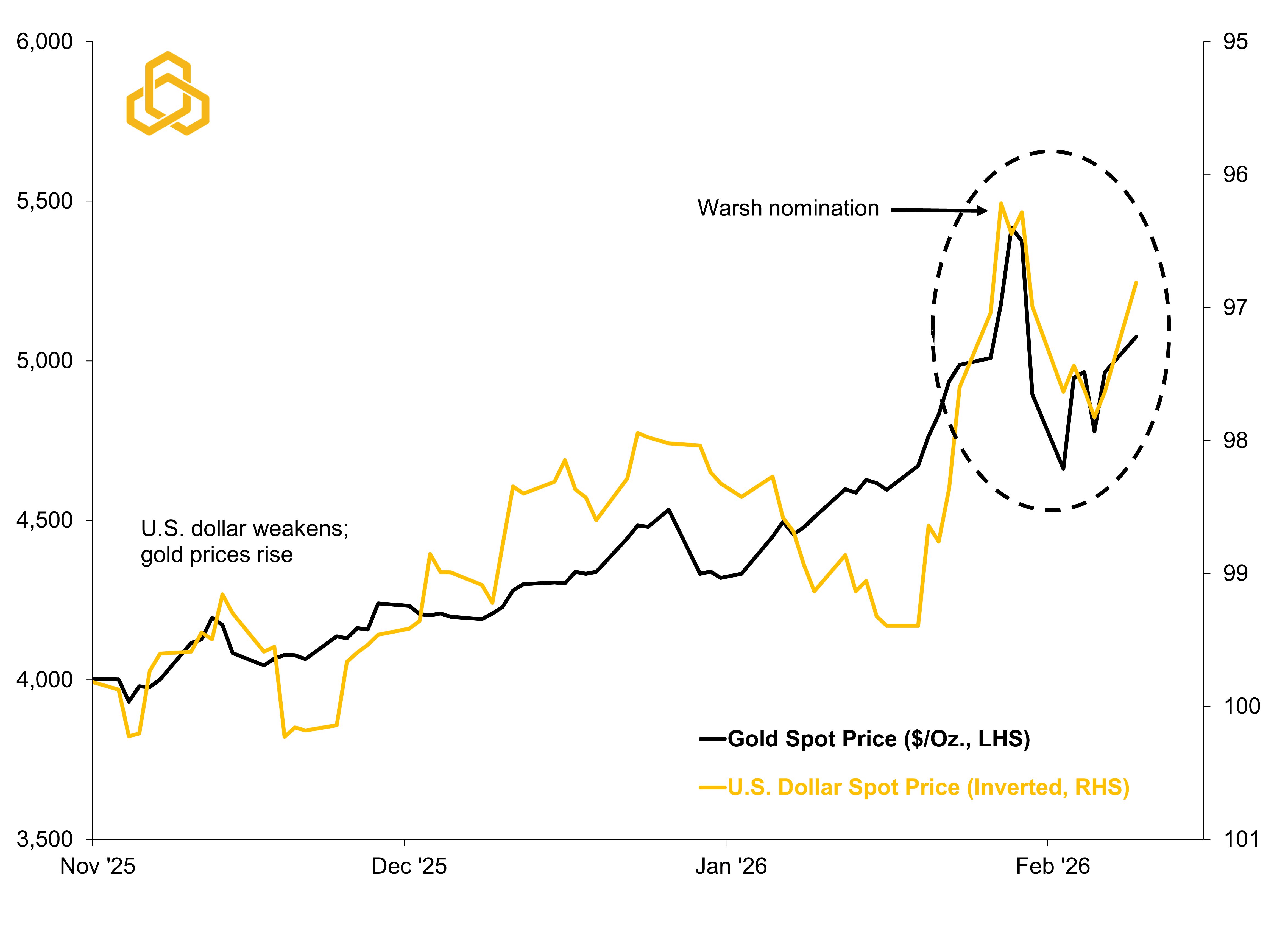

This philosophy triggered a sudden repricing of the dollar debasement trade – a strategy where investors move money out of cash into “hard” assets to hedge against a devaluing dollar (see figure 2). Some of this was a natural correction; gold and silver had rallied 24% and 62% year-to-date, respectively, leading up to the announcement.

Figure 2. Gold Spot Price vs. U.S. Dollar Spot Price (DXY)

Sources: Bloomberg L.P. and Potomac. Data as of February 9, 2026.

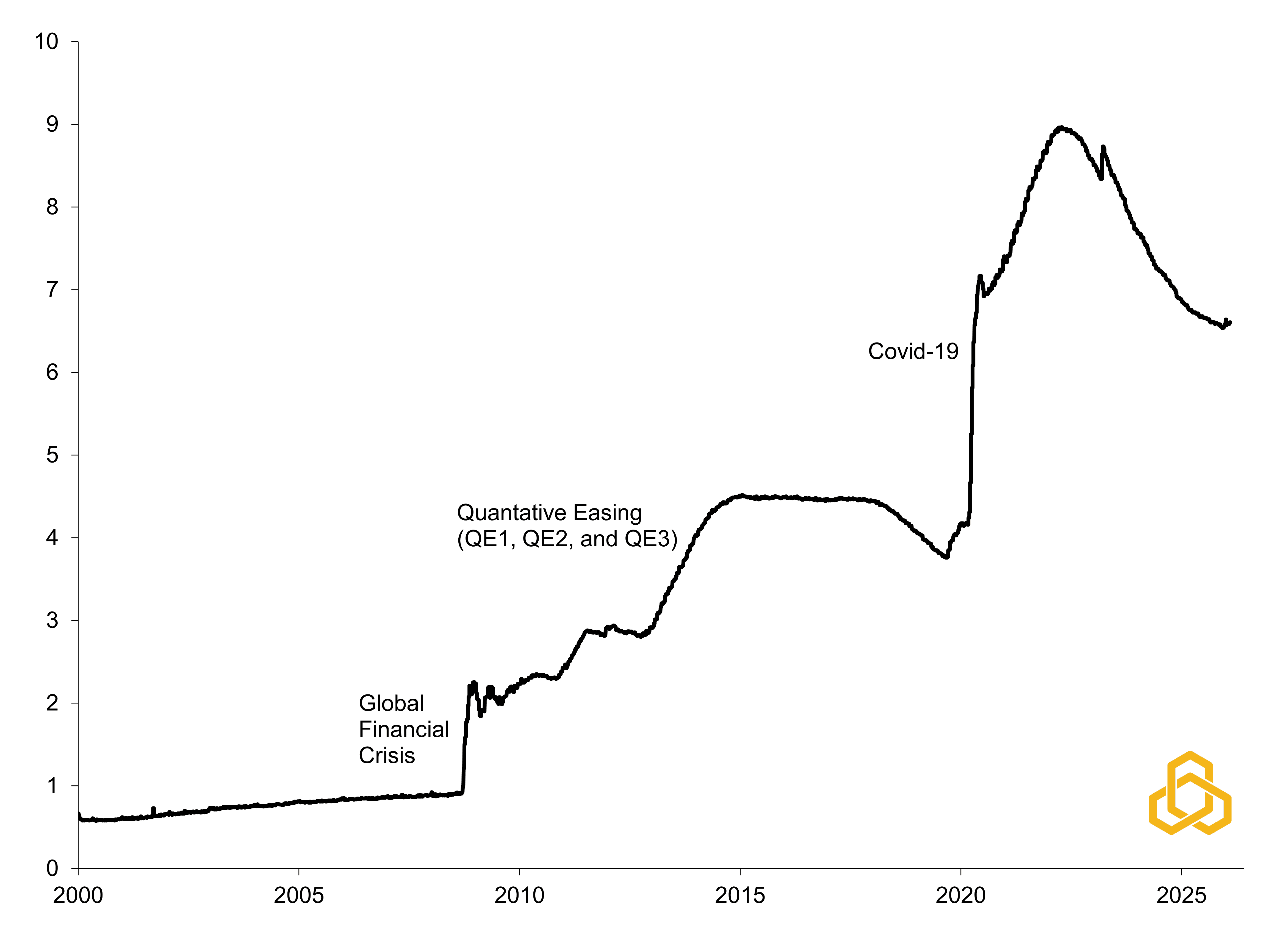

However, the primary trigger was the realization that a Kevin Warsh-led Fed might unwind its balance sheet to “pay for” the lower rates President Trump desires (see figure 3). Essentially, “QT for Rate Cuts,” which could strengthen the dollar.

Think of the Fed’s balance sheet as a pool of water:

Quantitative Easing (QE): Adding water to the pool increases liquidity, making dollars more "plentiful" and therefore cheaper.

Quantitative Tightening (QT): Draining the pool reduces the number of dollars, which often strengthens the currency.

Figure 3. Federal Reserve Bank Balance Sheet (Trillions of Dollars)

Sources: Federal Reserve Board, Bloomberg L.P., and Potomac. Data as of February 9, 2026.

Can Warsh Do It?

Possibly. Ironically, Kevin Warsh is known as an “architect” of the balance sheet, having managed its technical setup during the 2008 crisis. However, he cannot move unilaterally; he needs a majority (7 out of 12 votes) on the Federal Open Market Committee (FOMC), and internal resistance is brewing.

At least four regional presidents have expressed concerns that an aggressive unwind could cause rate volatility or “over-tighten” the policy, putting a cooling labor market at further risk. To make substantial changes, Warsh would likely have to build a stronger consensus among the dissenters.

The Appointment Hurdle

Warsh is slated to succeed Jerome Powell on May 15, 2026, and there is little evidence that he will not be appointed. However, the confirmation process faces a unique political backdrop. Senators Elizabeth Warren (D-MA) and Thom Tillis (R-NC) have signaled they may delay proceedings until a DOJ investigation into the Federal Reserve’s $2.5 billion building renovations is resolved. If the process drags past mid-May, Vice Chair Philip Jefferson will serve as acting chair.

The Warsh Doctrine = Independence Cuts?

Warsh has long argued that the Fed violated the spirit of the 1951 Treasury-Fed Accord. He believes the Fed should limit its holdings to short-term T-bills rather than long-term bonds or mortgage-backed securities (MBS) because the Fed is encouraging government deficits by buying long-term debt and keeping rates low. There may be some truth to this.

However, we suspect that the real reason that President Trump selected Warsh has to do with a “gain-of-function.” By reducing the Fed’s ability to use the balance sheet as an unconventional tool and injecting the Treasury Department, a “Warsh Doctrine” could give the Treasury (and the President) more control over the Fed’s plumbing (quantitative easing and tightening).

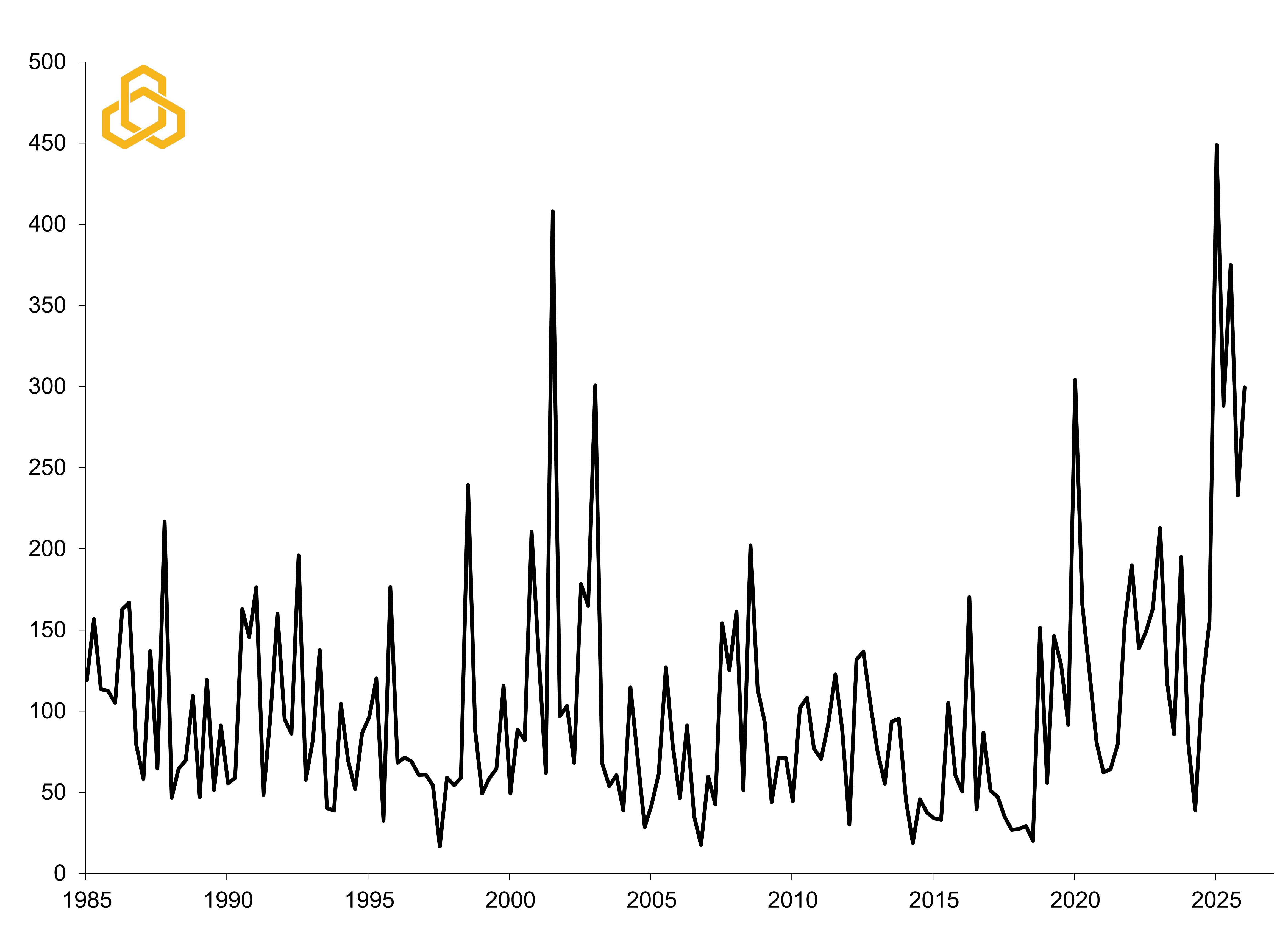

Warsh’s appointment is unlikely to change the market’s expectation for one or two more rate cuts in 2026, but we would not be surprised if monetary policy uncertainty stays elevated as the debate eventually shifts from “rate cuts” to “independence cuts” as the Warsh reality kicks in.

Figure 4. U.S. Monetary Policy Uncertainty Index (Average = 100)

Sources: Baker, Bloom, and Davis, Bloomberg L.P., and Potomac. Data as of January 31, 2026.

PFM-308-20250211

Potomac Fund Management (“Potomac”) is an SEC‑registered investment adviser located in Bethesda, Maryland. Registration does not imply a certain level of skill or training, nor is it an endorsement by the SEC. This material is for general informational purposes only and does not constitute investment advice, tax advice, or a recommendation regarding any specific product, security, strategy, or investment decision. Readers should not assume that any discussion or information applies to their individual circumstances. This communication does not constitute an offer to buy or sell any security or a solicitation to provide personalized investment advice for compensation. Nothing herein should be construed as individualized or tailored advice delivered over the internet.

Opinions expressed are current as of the date of publication and may change without notice. Information obtained from third‑party sources is believed to be reliable, but Potomac does not guarantee its accuracy or completeness and is not responsible for any third‑party content referenced or linked in this material.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. For additional important disclosures, please visit potomac.com/disclosures.

Explore our latest insights, watch the “Who Are You?” series.

potomac presents