By

Dan Russo

•

Feb 17, 2026

The Weight of the Evidence

Dan Russo, CMT

February 17, 2026

There is never just one thing. Those who know us well understand that in our composite model, there’s rarely a single input that gets us into the market, and rarely one that gets us out. We rely on combinations of systems to determine whether the weight of the evidence supports being invested.

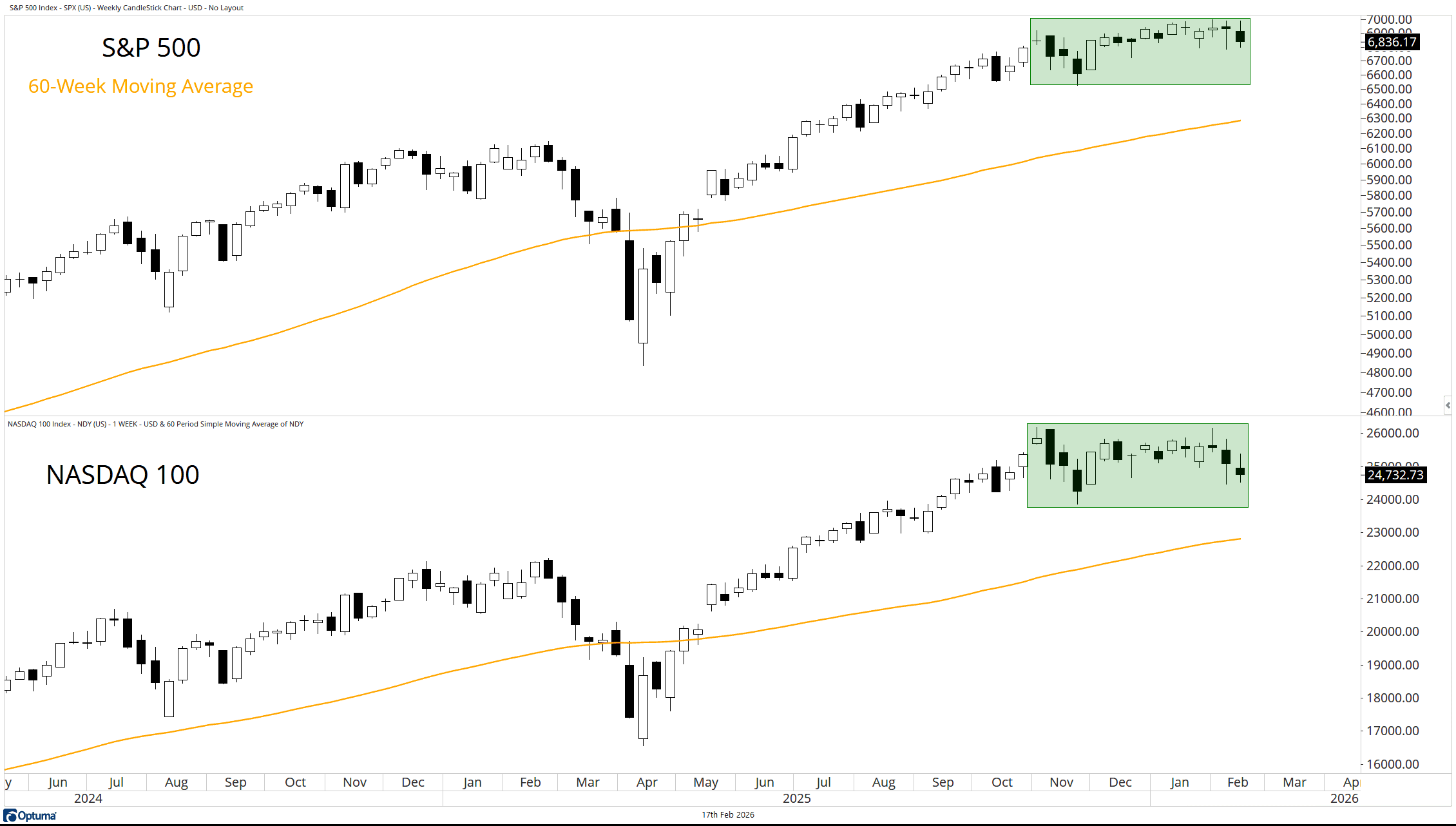

Right now, that weight remains somewhat compelling for equity bulls. However, the weight of the market itself may be getting harder to carry, especially as investors appear to have adopted a “shoot first, ask later” mindset when it comes to Artificial Intelligence.

Source: Optuma

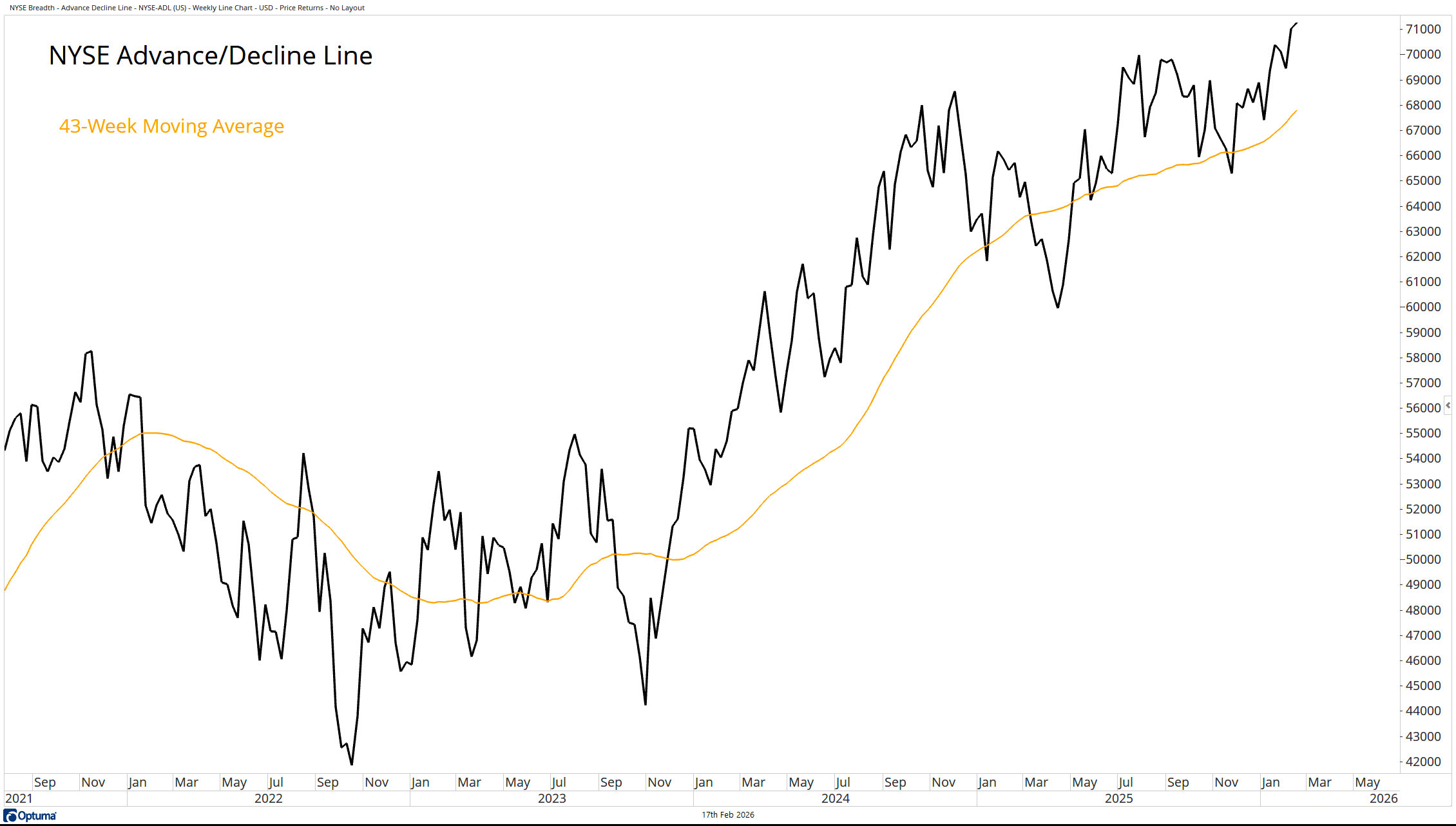

NYSE Advance/Decline Line

As the major averages consolidate, more stocks continue to move higher than lower. The NYSE Advance/Decline Line made a new high last week and remains above its rising 43‑week moving average.

Source: Optuma

Generally speaking, this is a bullish development. Historically, investors should expect the averages to eventually follow the individual stocks but…

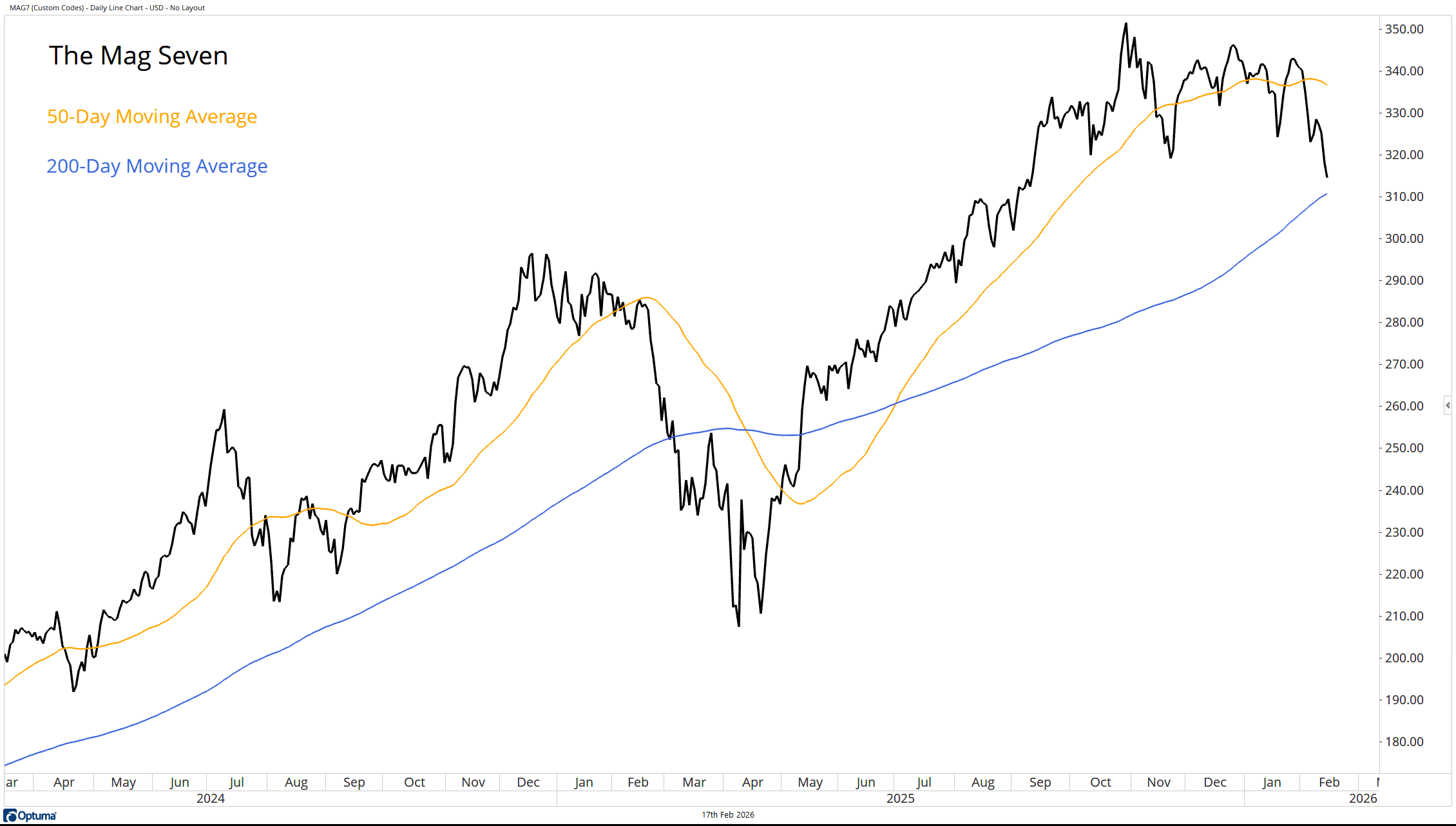

The Mag Seven

The market’s heaviest weights are now under pressure. An equal‑weight index of the Mag Seven shows that, at a minimum, the intermediate‑term trend has shifted from up to flat. The group is trading below a now‑declining 50‑day moving average and is approaching its 200‑day moving average.

The simple reality is this: prolonged weakness in the largest weights may become too much for the rest of the market to offset.

Source: Optuma

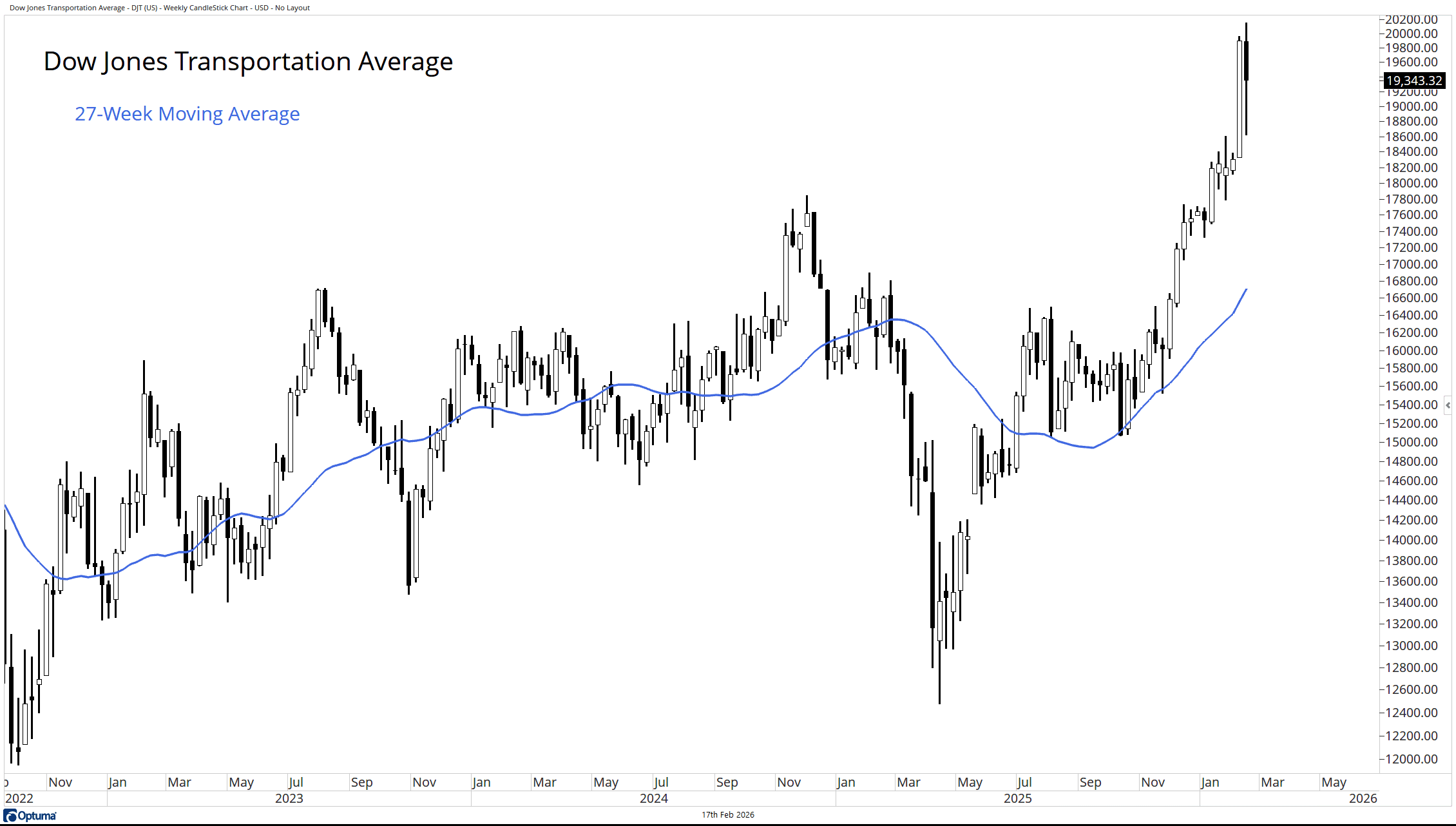

Dow Jones Transportation Average

There’s an added wrinkle to the story. When it comes to anything even tangentially related to Artificial Intelligence, investors appear eager to shoot first and ask questions later. We’ve all seen the carnage in software stocks as fears of “vibe coding” disintermediating established SaaS leaders took hold.

But last Thursday, that fear spread to the Transports.

According to The Wall Street Journal, the sell‑off appeared to be sparked by a press release from a Florida‑based firm called Algorhythm Holdings, which claimed its SemiCab unit boosted customers’ freight volumes by more than 300% “without a corresponding increase in operational headcount.”

Bloomberg added:

“Logistics stocks plunged on Thursday as the group became the latest victim of the artificial intelligence ‘scare trade.’ At the center of the selloff: a former karaoke company with a market value of only $6 million.”

A former karaoke company. Let that sink in.

Investors aren’t waiting around. Their finger is clearly hovering over the sell button.

Source: Optuma

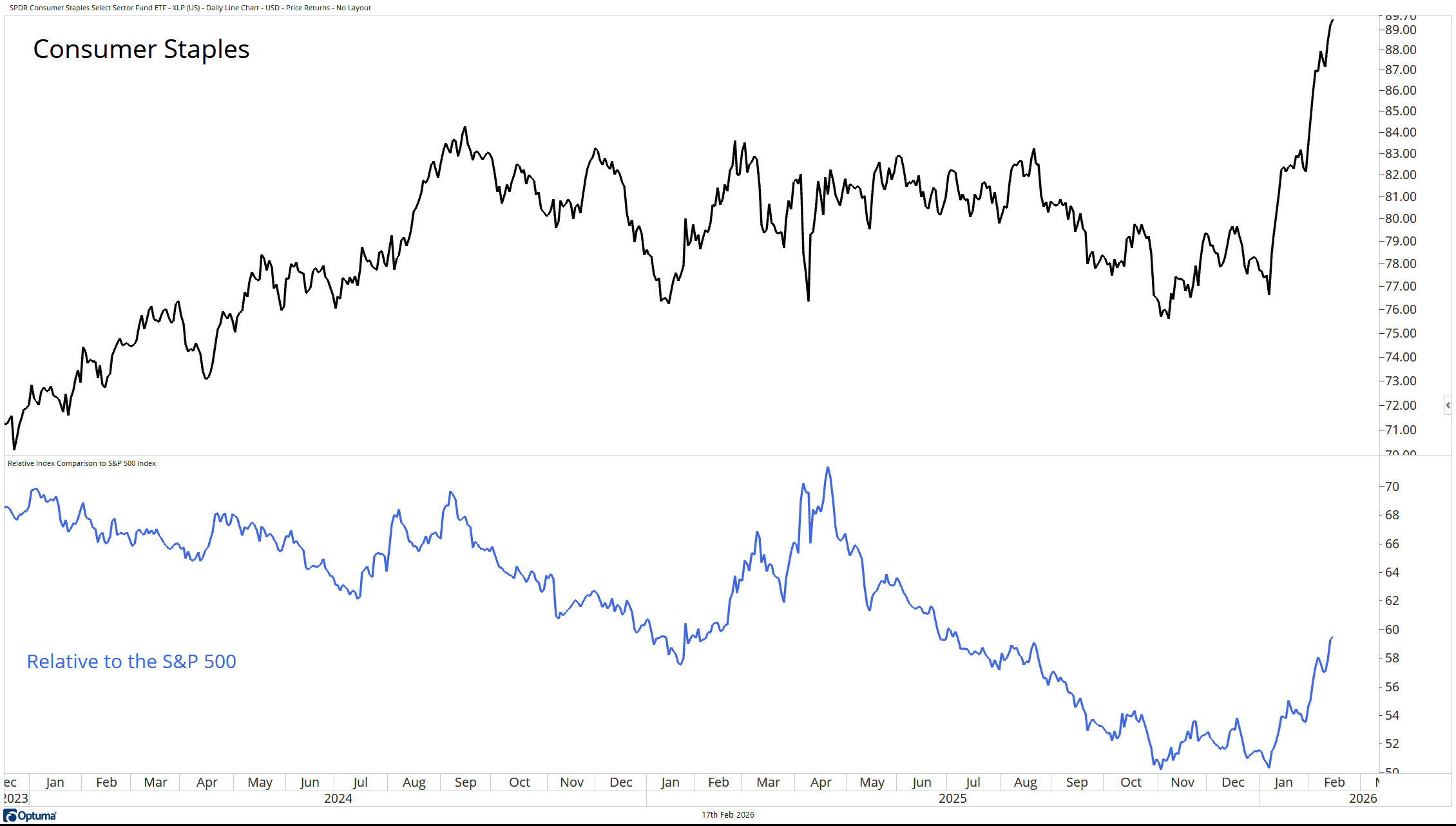

Consumer Staples

All of this is unfolding as investors continue to rotate into Consumer Staples—a historically defensive corner of the equity market. The group has broken out to new highs and has turned higher on a relative basis versus the S&P 500.

Source: Optuma

Final Thoughts

The weight of the evidence still leans bullish. Breadth is healthy; leadership beyond mega‑caps remains intact, and major indices continue to respect long‑term trends. But markets don’t exist in a vacuum and investor behavior matters. The real question is can the market handle the weight of weakness in its largest leaders and the weight of the A.I. mindset.

PFM-3087-20260217

Potomac Fund Management (“Potomac”) is an SEC‑registered investment adviser located in Bethesda, Maryland. Registration does not imply a certain level of skill or training, nor is it an endorsement by the SEC. This material is for general informational purposes only and does not constitute investment advice, tax advice, or a recommendation regarding any specific product, security, strategy, or investment decision. Readers should not assume that any discussion or information applies to their individual circumstances. This communication does not constitute an offer to buy or sell any security or a solicitation to provide personalized investment advice for compensation. Nothing herein should be construed as individualized or tailored advice delivered over the internet.

Opinions expressed are current as of the date of publication and may change without notice. Information obtained from third‑party sources is believed to be reliable, but Potomac does not guarantee its accuracy or completeness and is not responsible for any third‑party content referenced or linked in this material.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. For additional important disclosures, please visit potomac.com/disclosures.

Explore our latest insights, watch the “Who Are You?” series, or subscribe to our blog

potomac presents